The next subject to discuss once you know what a trend is, is another very important concept to the trader – support and resistance. If you find a trend, generally you just know whether the price is tending to go up or down, which is good information but doesn’t tell you anything about other expectations. When you learn about support and resistance, you have a powerful tool which can help you decide early on if a new trend is starting, and can also help you know when to look for the end of a trend. This is very important when spread betting, as it will indicate when it may be time to get out and take your profits.

The most basis concept in technical analysis is that of support and resistance levels. A support level is a point or an area at which buyers will come into a market in order to go long. Their combined actions will have the effect of soaking up all excess supply and give support to the price i.e. these are instances where there are typically more buyers than sellers. This will stop a market from falling further, at least temporarily and is easily discernible on a chart of the price action. Resistance is the exact opposite, and denotes a price level that has normally brought about more sellers than buyers.

The price of a stock / commodity / forex moves, tends to move in trends. The price trends can be broadly categorized as short term and long term. Of course, these are relative terms depending upon your investment perspective.

Once a trend is established, prices tend to move in that direction. From the historical price data, it is possible to determine the support and resistance levels. If a stock (or commodity / forex) is in an up trend, it is possible to use technical analysis to determine the price at which it will get support and the price at which it will face resistance. Support and resistance lines usually run parallel at an angle.

Support and Resistance – Part I: the Support Level

As we have said above support is a price level that you don’t think the price is going below. It is nothing to do with your hopes for the price, but everything to do with what the price has done in the past. A support level is thus an area on a chart lower than the current price where the buying is strong enough to overcome the selling pressure – creating a trough or low. History repeats itself, as we learned, so when the price goes down to a level from which it has come up before, we have a certain expectation that it might come up again. In practical terms, when it goes down to a certain level enough people are interested in buying it and paying that price that the price stops going down – supply and demand in action.

The reasons why they would act in this manner can vary and include the following: there may be a group of value investors which believe the price of a stock to be cheap at a certain price based on their analysis on the fundamentals of the company. Equally there may be another set of relative-value traders that may view the price of the stock to be cheap relative to that of a peer company. There could also be a group of speculators who have watched the stock fall from a high level who now think it is cheap relative to where it was trading only a short time ago. The directors of the company equipped with their knowledge of the prospects for the company may decide to buy some stock for their own accounts at this low level. As you can see the reasons why a particular stock receives support at a particular level can be plentiful. Technicians do not concern themselves too deeply with the reasons behind why this support comes about and instead focus on the impact of this support. Indeed, the reasons why there is support may not be known until sometime in the future after the price has bounced off the support level.

Once the selling pressure is absorbed then the price will cease to fall. Short term orientated traders seeing that some support has come into the market may also go long at these levels for quick profit. In the absence of any additional selling pressure their buying activity has the effect of increasing the price. Let’s assume that there were some sellers who initiated short positions at lower levels and sold to those participants that provided the initial support. These sellers would then find that the price is moving against them. If their horizon is relatively short and the rise in the price is greater than their risk threshold then these short-sellers will likely seek to exit their positions which will further add to the buying activity driving the price higher.

We can see from this rather simplified example that once the price of a particular market starts moving then this can force participants with positions on to act as well as those players without positions on to come to the market. In addition, the actions of these participants can be anticipated to some degree.

From the bestselling book Reminiscences of a Stock Operator, the great speculator, Jesse Livermore, is quoted as saying: “You can spot…where the buying is only a trifle better than the selling. A battle goes on in the stock market and the tape is your telescope.”

Support and Resistance – Part 2: the Resistance Level

Following on from part I, we can suppose that once the price starts to rise it will attract more attention from others sat on the sidelines. For the sake of this example let’s assume that we see an equal amount of new sellers as buyers emerging from the sidelines causing a halt to the rise in the price. Let’s mull over some of the possible reasons for these participants to act in the way they do. A rising price may give a totally different group of participants such as institutional investors confidence in the prospects of the company who then go long the stock. Conversely, we may see selling pressure from a new set of value investors and relative value traders who deem the price to be too high. We could also see additional selling coming from those investors who were already long the stock before it started to fall that now want to liquidate their holdings. These investors sat and watched as the price fell below their entry point and are looking to bail as soon as they can break-even. This is a behavioural phenomenon and is something we will explore in later on articles.

All in all, this selling pressure creates a resistance level which – at least temporarily – prevents the price from going any higher. What we may then see is the market trade in between these two support and resistance levels. Once they have been defined they may give participants further confidence in using these levels to trade which adds to their significance.

Having covered the basics of the formation of patterns we will now go on to suggest ways in which these can be used when trading.

Resistance is a price level that the stock finds it hard to go above. Again and again the price will rise, only to hit this “ceiling” and fall back down. A resistance level is thus an area on a chart higher than the current price where the selling is strong enough to overcome the buying pressure – creating a peak or high.

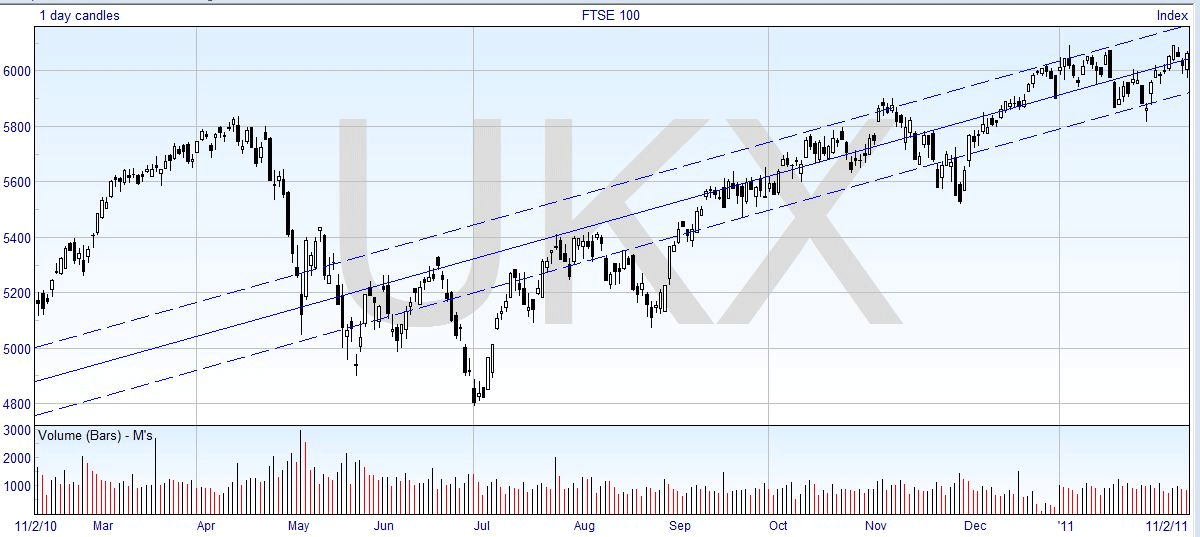

The idea is to place your spread betting trade around the levels of support and resistance. So at a level of support, you buy and at resistance you sell. Often resistance and support levels are at whole numbers – there is no technical reason for this, only the psychological one. I mean, why the heck would an index which is comprised of many different stock prices actually hit a whole number and bounce? It happens. Look at this chart of the FTSE with lines at each 100: –

See how the index was pushing at 5900 in November 2010, backed away and then pushed again in December, pausing before it managed to break through. Then the 6100 was pushed in January, failed to rise above, and was pushed again in February, and failed again. The price seems to stagger in steps that pause around the whole numbers – in February it just rattles between the 6000 and 6100 for a time before it breaks back down. So our expectation is that support and resistance “contain” the price movement, at least for a spell, until the price builds up sufficient momentum to go through.

The FTSE 100, as the name suggests, is based on the prices of 100 shares so it seems almost crazy that it acts in this way. As we’ll repeat from time to time, when trading it is important that you see what the market is actually doing, and don’t be concerned with what you think it “should” be doing. More people have lost money trying to rationalize prices, and those who make money are the ones who act on the facts.

There’s another important fact to be pointed out on the above chart. When a support or resistance level is broken, and the price passes through it, it often becomes a hurdle for the price coming back. That is, the old support level becomes a resistance level, and an old resistance level becomes a support. Look at the 5900 again. After it was broken in December, the price dropped back to 5900 before climbing up to 6100. You can also see minor bounces at the 6000 level, both from above and below.

Another point is that you can look back a long way to find an established support or resistance level, and it may still hold good. For instance, the 5500 level provided support in September 2010, and the price came back to it at the end of November, found support and went back up again. Sometimes you will even see a support or resistance level from a few years ago that is re-applied in the current chart. This is one of the reasons that you should look at several different time-frames of chart in deciding on your bet.

Support and Resistance – Part 3: how to use Support and Resistance levels in Practice

We suggest ways to use support and resistance levels to either formulate a trading strategy or to adjust a strategy to take into account this phenomena.

Breakout from Support and Resistance Levels

Breakout occurs when the price shoots above the resistance level, or drops below the support level, When a breakout occurs, traders can either go long or short. Thus, breakout from the support and resistance levels is an important visual indication of the change in stock / commodity / forex price.

Candlesticks have specific patterns that indicate that the price has reached a breakout or is about to reach a breakout. CandleStrength incorporates this principle in its online analysis tool to help you take educated decisions about your investment.

Other Ideas

A simple trading strategy could be to wait for these to develop and then go long once the price reaches the support level and to go short once the price reaches the resistance level. Alternatively, a trader who is bullish and is already long may choose to place his stop somewhere below the support level. This would be on the thinking that there is a well-defined support level which will act in favour of his position if the price were to drop. He would not want to place his stop above the support level as he will not benefit from the impact that this creates. Instead, he would place it below the support level and get stopped out only once the level has broken. When deciding how far below the support level to place his stop, this trader would balance the following:

– placing the stop below and close to the support level will limit his loss to the downside if the level were to break

– however, if the support level were to break by only a small amount and then rally again (known as a false breakout) he could get stopped out and rue his luck as the price continues upwards.

When looking at a chart the human eye is prone to see patterns, indeed it may see patterns in randomness. We note the following observations on support and resistance levels in range-bound markets:

– the greater the volume of trade that occurs at these levels then the more significance these levels will have, and the greater the impact there will be if they are breached.

– the greater the number of times the market trades to these levels without going through them the greater the significance they have.

– trading within these two levels is said to be range-bound trading. That is because the price may fluctuate up and down between these two levels but it is essentially flat without an underlying trend. The trading that occurs between these two levels tends to be random in nature, especially in the middle of the range.

– the more time that is spent at either of the two extremes is deemed to be significant and could signal a possible break-out (we will explore the relevance of time in the market profile section).

– once then is a breach to either side we can estimate the price move that results to be at least equal to the size of the initial range.

– once broken we may see a previous support line acting as a new point of resistance for any subsequent rally in the price. For a possible explanation behind this think back to those investors that went long the stock at the previous support level. These investors may then place their short limit orders at the same price as their entry level once the support level is broken for the sole purpose of breaking even on the trade (that is, to avoid taking a loss on the trade).

So in summary, support and resistance are price levels that the price has some difficulty going through, but once it has built up momentum to carry it through, then these same levels provide resistance to the price coming back. Obviously, support and resistance levels are broken fairly often, but you can usually expect the price to bounce a few times before it “builds up speed” to break through.

When a price start to go down towards a support level, there are basically two possible scenarios. Support can hold meaning that market participants are waiting to enter the market at that level, in the belief that the market will reverse or support can break. In the second outcome lots of traders with stop losses in places will be exiting.

Looking at Gold for instance; the metal has approached the $1,800 mark several times in 2012 only to retrace back from there; the market doesn’t seem convinced that the commodity should be trading above that price. As such one one can use this weakness by selling short the gold market at the upper levels and setting a stop just over the resistance level.

You will see prices go through the support and resistance levels and come back, occasionally. It doesn’t really count as breaking the level if it’s just a little stab and doesn’t stay for long. Some people allow the penetration of the level to be about 3% before they consider it significant, and you have to remember that trading is not a precise science. But the longer the price stays past for level and the further it goes the more it looks like a “breakout” is happening, and you cannot expect the price to remain contained in future. If the break is clear the market is likely to move down or up a lot so you have a good risk-reward in such situations.

Want to spread bet successfully? Devise a trading strategy that has an excellent risk reward ratio coupled with astute timing with entry and exit at support resistance levels.