The past few years has seen an explosion of trading products and services in global financial markets, including contracts for differences, exchange traded funds (ETFs), spread bets, binary options, covered warrants, and forex trading products to name just a few. Each of these products has developed a niche market of its own with some finding favour as mainstream financial products, like spread betting and CFDs which have really taken the world by storm.

Today, one can confidently say that financial spread betting is no longer a niche option when it comes to speculating on the stock markets and financial trading. Economic developments such as changes to the UK tax regime have created a marked shift in the way many stock market traders speculate, and spread betting is taking an increasingly prominent role.

“If you save or invest money, you’ll generally have to pay tax on any interest or income you get, but there are some ways of investing and speculating that give you a more efficient, or even tax-free, return. One of these is spread betting. With CGT having risen to 28% in 2010 for higher rate tax payers, and financial spread betting profits being presently free of Capital Gains Tax and stamp duty, it is no wonder that spread betting is a rapidly-expanding area of financial trading.”

Financial spread betting originates back to 1974 when Stuart Wheeler established IG Index to allow investors to trade the price of gold without incurring hefty charges through the exchange controls applied if the actual metal itself was bought. Initially, financial spread betting was popular mainly amongst institutional investors, city traders and high-rollers, but the trading product has now started to becoming more mainstream with private traders.

In fact, if you were to make a list of financial products that have attracted the interest of the wider investing community over recent years then spread betting would definitely be near the top. It has been around for decades but developments in technology and financial markets has meant that spread betting as a trading medium has soared in popularity in the the last few years.

But what is spread betting and why is it so popular?

Do you recall Play Your Cards Right (who could forget ‘Bruce Forsythe, HIGHER HIGHER! LOWER LOWER!’), where the contestants have to decide whether to bet that the next card to be turned over would be high or low? Yes – spread betting in its simplest from! Of course spread betting can appear daunting when you are just starting out but once you’ve gained a bit of experience it’s a brilliant way to trade. This guide is designed to explain all the ins and out of financial spreadbetting.

A Derivative Product

When I first heard about spreadbetting I actually asked the person telling me about it, “What is the point of it? After all you are not actually buying anything?”

Quite true. Spreadbetters merely punt on the price of the financial instrument. If I “buy” gold I am not entitled to take delivery of the metal. Nor will buying HSBC mean I have bought that stock.

Other than the thrill of the trade it is in fact quite pointless. If you are a good trader you can make bags of cash using leverage. The alternative is to use margin on a stock account, but this option would not give you access to the currency or bond markets. And the amazing leverage that spreadbetting offers could not be matched by having even a margin account.

One of the greatest things is that amateur traders can open an account for a very small outlay, alternative products such as Contracts for Difference (CFD’s) often require larger amounts of startup capital and brokers can deny you an account if you have no experience in the trading arena. Spreadbetting in this case is the ideal spring board.

What Spread Betting is, and What it is Not

There is some confusion about what spread betting is, and what is not. Spread betting originally came about in the sports world when gamblers were looking for a way to bet on an outcome which was not just winning or losing. With spread betting, you can gamble on how many points a team will win by, and your winnings depend on how right you are. The spread is a range of points, and a common form of spread bet is whether the favourite will win by more or less than the point spread offered by the bookmaker.

But this guide is not about sporting events, or even about gambling in the usual sense of the word. The ‘spread betting’ activity that you will learn about here is more appropriately described as financial spread betting, and winning or losing depends on how well you can predict the movements of the financial markets or other securities. The concept itself may initially appear daunting, but the basic principle of trading by ‘buying’ or ‘selling’ an interest in the price movement of global shares or the world markets is relatively simple.

Spread betting providers offer a prediction of where they think a particular stock or index will close at a given time, allowing speculators to trade or bet on the accuracy of that estimation. People who believe a prediction may be too low can ‘buy’ on the price, whereas those who think the spread is too high can ‘sell’.

You will see later on in the guide how you can study the markets and make a profit. In this way, financial spread betting is very similar to stock trading, although it is available on a much wider range of financial instruments and it has some significant benefits with regard to taxation. The obligatory warning is that it is quite possible to lose as well as win with spread bets, and you can lose more than your original stake, or deposit.

“Spread betting provides you the opportunity to attempt to take advantage of movements in financial markets, so if you think that the FTSE will continue rising as more evidence of green shoots sprout up, then you can by the index in a spread bet. Or you can place a buy bet on a particular stock if you believe if will outperform the index. Note that there’s no physical ownership. You are simply trading on the movement of the price, speculating whether the market will go up or down.

Spread Betting? Spread Trading?

Spread trading and spread betting are two interchangeable terms, they mean the same thing. Spread betting is an alternative way to trade the financial markets. Spread trading works by reflecting the action of stock indices (FTSE, Dow, Nasdaq, S&P…etc), individual shares, commodities..etc

The term ‘spread’ is used to describe a quote made up of two prices that straddly the underlying market price. The higher/offer price is for buyers and the lower/bid price for sellers. If you buy and the market rises above the higher/offer price you generate a profit and likewise if you sell and the market drops below the lower/bid price you make a profit. Therefore, you can make money on spread trading by predicting the market to go downwards as well as upwards. Markets include financial indices like the FTSE 100, Dow (Wall Street), NASDAQ, currencies like the Pound, Euro and the Dollar and commodities such as Gold, Silver, Wheat, Sugar..etc. These are all separate individual markets. When we refer to the market, we mean any individual market you happen to be trading at the time. The most common markets are the FTSE 100 and the Dow.

Financial Bookmakers

Let’s not kid ourselves about a spreadbetting firm; they are nothing more than financial bookmakers. But; instead of betting on the 3.30pm at Cheltenham punters have the chance to bet on a range of financial markets. And while going into the high street bookies (at least the last time I was in one) seems seedy, almost an underworld type of experience, the world of online spreadbetting in contrast does at least appear to be a tad more sophisticated.

One of the greatest traders around – Jesse Livermore – started in the bucket shops of America at the turn of the 20th century. Spreadbetting can actually be compared to the bucket shops of Livermore’s time. Although, these days chalkboards have been replaced with sophisticated charting and trading software.

The spread betting industry was among the first in the UK to recognize the potential of the internet as the basis for a trading platform; and it wasnt long before spreadbetting companies such as IG Index and CMC were the main players in a growing niche market. Leaving many of the more traditional stock brokers and banks behind in terms of technology for their clients.

Spreadbetting companies claim to make their money from the “spread” only. The “spread” is the difference between the buy and the sell price when a client opens and closes his position. This is an issue hotly debated by spreadbetters. The brokers claim they offset their clients bets, this means that should a client win large amounts of money then the bookmaker in turn has hedged his loss in the real market. It is impractical for these companies to hedge every bet that is placed (and who would want to as a lot of clients lose money consistently) but a bookmaker will monitor large bets and their successful clients and hedge accordingly.

Spreadbetting firms don’t want their new customers to go broke (at least not immediately hmm) its bad for business and so most go out of their way to offer virtual trading platforms, trading courses and other tools to help a client to develop his or her skills. Some spreadbet companies allow their clients to make really small bets initially (pennies) while the client gets used to the way it all works. While other companies enforce the trader to place a stop loss order even if the trader thinks he doesn’t need one.

How it Works

When you decide to place a spread bet, you will be quoted a selling price (also known as the bid) and a buying price (also known as an offer). The difference between these two prices is the spread.

- The closer the selling and buying prices are, the less the market will need to move before you make a profit.

- Spread betting does not incur any fees, commissions or stamp duty – all you have to pay is our spread.

- If the market moves against you, you may incur losses so you should only speculate with money you can afford to lose.

Spreads and Margins

Spreads

Spread betting providers typically offer clients very competitive spreads across a wide range of financial markets reducing the amount you pay to open and close each trade and in turn allowing you to potentially maximise your returns.

Margins

Spread betting is a leveraged product which means you are able to trade without having to put up the full notional value of the position. Trading on margin also increases risk by magnifying the extent of the potential losses. Providers also typically offer stops and risk management tools allow you to further reduce your margin requirements and give a greater degree of flexibility when managing your account.

Advantages of Using Spread Betting to Trade

Financial spread betting has several advantages compared with other forms of financial trading. Firstly, it is a geared or leveraged way of profiting from the markets, and this simply means that the value of your money is multiplied. Rather than having to buy stocks and making a few per cent profit when the price rises, you can spread bet on the stock with much less capital than you would need to buy it, and make the same good profit when the price goes up. This gearing is incidentally also the reason that you can lose more than your initial investment if you bet the wrong way, and the purpose of this guide is to give you pointers to winning more than you lose.

Secondly, because you never buy the stock you are not charged stamp duty, and you also do not pay trading commissions. The profit for the dealer or broker comes from the spread between the buying and selling prices that you will be quoted when you go to bet. Additionally, because betting is a form of gambling, any winnings are not subject to capital gains tax in the UK and some other countries. It’s been said that if you have no other form of income then the spread betting winnings could be regarded as your income and therefore be subject to income tax in the UK, but this has not proved to be a problem to most spread betters.

For these obvious reasons, financial spread betting has become very popular in recent years, and together with contracts for difference (CFDs), another very similar way of leveraged trading, has become the preferable way of profiting from the markets for many traders.

Financial spread betting is one of many forms of trading the global financial markets – and it is regulated by the United Kingdom’s Financial Services Authority (FSA).

Spread Betting Explained

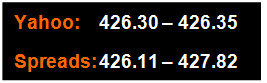

A quick search on Yahoo Finance* for the share price of BP looks something like this:

For this example, you can forget most of these numbers and their descriptions except for two: Bid (426.30) and Ask (426.35), and the difference of .05. All you need to remember at this stage is that Ask represents how much each share of BP will cost you to buy and Bid means how much you will get if you have shares of BP that you wish to sell. Prices are quoted in pence. The difference of .05 between the two prices of the bid and ask is called the spread.

A quick search on my spread betting provider’s website for me to open a spread bet shows the following quote for BP:

You can see from the comparison box above that the spread of 426.11 – 427.82 is wider than the spread from Yahoo at 426.30 – 426.35.

You would be able to achieve an actual price closer to the Yahoo quote through a traditional stock broker. This is how the spread betting firms make their money; by quoting a slightly wider spread than you could achieve through a traditional stockbroker.

This is a small cost compared to traditional share trading, something we will look at later in the book. Spread betting remains the best entry level product for new and intermediate traders in the UK; the costs are low, spread betting firms are regulated under UK law and profits are free of capital gains tax at the time of writing (May 2011).

* Yahoo finance stock market prices are from the London Stock Exchange and are delayed by 15 minutes.

Some Observations

We will be returning to more in depth examples of a spread bet later. For now, we can say that:

- Spread betting has slightly wider spreads than traditional share trading;

- Prices of spread bets on UK shares match the prices of the actual UK stock market i.e. they are not random;

- Unlike traditional share trading, profits from spread betting are not subject to capital gains tax under current (May 2011) UK tax laws;

- Spread betting firms are regulated under UK law by the Financial Services Authority.

Spread Betting Share Example

Buy or Sell, Long or Short

When spread betting you can choose to buy or sell any of our markets.

- Deciding to buy, or take a long position, means you will make a profit if the market you have traded rises in value.

- Deciding to sell, or take a short position, means you will make a profit if the market you have traded falls in value.

- Unlike other methods of trading, spread betting lets you take advantage of rising and falling markets and all gains are free of tax!*

Long position examples (buying)

After doing some research you believe the Vodafone share price is going to go up -:

Short position example (selling)

You believe the Vodafone share price is going to go down -:

Spread Betting Index Example

Just to make clear what a spread bet looks like, here is an example of a spread bet placed on the FTSE 100, the major stock market index for the London Stock Exchange.

You ask your spread betting broker for a quote on the FTSE 100, and he will give you two figures, say 5701 and 5703. In this case he is quoting you a spread or difference of two points. The spread will vary depending on what underlying item is being traded on, and can also vary between brokers. If you want to bet that the FTSE 100 index would increase, you could “buy” at 5703; if you thought the index would fall, you could choose to “sell” at 5701. As mentioned above, you’re not actually buying or selling any shares, but these are the terms used.

For the sake of this example, assume you decide to buy at 5703. Rather than buying or selling physical shares in a company, the way it works with spread betting is that you bet a certain stake in either pounds sterling, dollars, euros per point (depending on what currency your account is denominated in) to determine how much you win or lose when you open a trade.

You buy at 5703. So as we said your spread bet is a wager of a certain amount per point, usually with a minimum of £1 per point. Say you decide to bet £10 per point. A little later the same day, your broker is quoting the FTSE 100 at 5765 and 5767, and you decide to take your profit. To close out the bet you now need to “sell” it, which you do at the lower quoted price of 5765. You bought at 5703 and sold at 5765 for a total point gain of 62 (5765-5703). At £10 per point you have profited £620. Now you can also see where the broker’s profit comes from – the actual increase in the buying and selling prices was 64 points, but as you have to buy at one and sell at the other, the broker profits by the amount of the spread. This is simple to understand, and there are no hidden fees.

Now you may have heard some negativity and rumours about financial spread betting, so let’s just clear up the misconceptions before going into more details. The first myth is that nobody wins at financial spread betting. That is obviously not true, otherwise nobody would do it and least of all the major institutions. The market for it is increasing at a rapid rate, as people come to understand the advantages over normal trading. However, statistics show that about 90% of people who dabble at spread betting lose money and give up in the first few months.

Why is this? Well, it’s probably because many people go into it unprepared, without learning the details of what they’re doing, and treat it as a bit of a gamble. Similar failure figures apply to most forms of trading. However, some people who are prepared to learn and put some work into it continue to make a substantial income. Hopefully, you are prepared to work at it and that is the reason that you are reading this guide to spread betting. The fact is that there are two sides to every spread bet, one thinking that the price will go up and the other sure that the price will go down. That means all spread bets will have a winner and a loser, or in rough terms 50% of spread betters will lose. It’s slightly more than that, because the broker takes the spread. The fact that far more than 50% lose means that those who win must be winning much more money than the amount lost by the failures, and as long as you plan and prepare to be on the winning side, this is good news.

Another myth is that spread betting is just like futures and options, implying that it is complex and likely to cost you large sums. This is not true at all, futures and options require a great deal of money to trade in comparison, and are much more complex to analyse. What they do have in common is that they are all highly geared which gives you the power to make more money, and that you can make money when the price is going up or down.

A third myth is that you need to be wealthy in order to spread bet. This isn’t true, you can open an account with as little as £100. While spread betting with this amount is not going to make you wealthy, it is enough to help you learn to trade. In a later chapter, I will talk about the psychology of trading and you will see that you should not trade with more than you can comfortably afford to lose, to avoid the irrationality of emotion. Being able to start with a small amount helps you to establish this mental attitude.

Finally, you may hear people saying “If it’s that easy, why isn’t everyone doing it?” The fact is that many people, an increasing number, are doing it even though they may not be shouting about it. It requires work, but that work is straightforward and easily understood, and this guide will explain how you do that.

By the way, it may have occurred to you that if in the example given above you had sold instead of bought, you would have lost £660, including the spread. Yes, you can and will lose on some spread bets. But you would really need to be asleep if you allowed this size of loss to happen. As you will see later, one of the secrets of trading is to “cut your losses” before they become large, and in practice you would have closed out this spread bet way before the loss got that high. We will see in the section on types of order that you can arrange for this to happen automatically, even if you’re not watching the market.

In summary, financial spread betting is a very efficient, in the sense of making the most of your money, way of trading on the financial markets, and is easy to understand. To make a consistent profit, you need to study the things that any trader needs to know, such as how to use price charts and how to analyse the price movements, and much of the rest of this guide is given over to discussing how to do this.