In my view, the misunderstanding of leverage is the number one reason why people lose money at spread betting. I have read countless horror stories on bulletin boards of how people bet too much and lost everything. Spread betting, by its very nature is a leveraged product. This means that you can lose more money than is actually in your trading account.

Think about it.

If a trader has £5,000 in their trading account, they bet too much and they end up losing £9000, that’s another £4,000 they have to find to cover their losses by paying back their spread betting provider. We will return this idea later with a practical example. For now, it is important that we focus on the things that will help us avoid being another horror story on a bulletin board.

Leverage in focus

In regard to spread betting, leverage (or margin) refers to the ability to purchase a larger amount than would otherwise be possible by using borrowed money from your spread betting provider at an extremely low interest rate.

Let us break this description down into its constituent parts:

- The ability to purchase a larger amount than would otherwise be possible.

- Using borrowed money from your spread betting provider.

- An extremely low interest rate.

To understand these ideas, we shall look at the portfolios of two different traders: Mark and Sally. Mark makes purchases of shares in the normal way and Sally uses leverage via a spread betting account. Both make identical trades but have different outcomes in regards to losses.

1. The ability to purchase a larger amount than would otherwise be possible

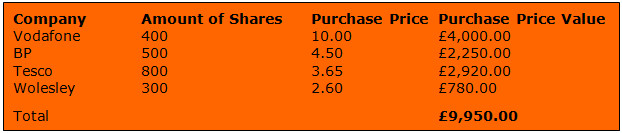

Mark’s share portfolio, starting capital: £10,000

Discounting commissions and stamp duty, Mark has used almost all of his money; he has used nearly all of his £10,000 on share purchases and only has £50.00 left in his account. Mark has not used any leverage.

Sally’s spread betting portfolio, starting capital £10,000

Sally has made identical purchases to Mark: £9,950 worth of exposure of shares. Sally only needs to pay her spread betting provider £1990 or 20% of the value of the shares she has purchased. This is what is meant by being able to purchase a larger amount than would otherwise be possible. It leaves Sally free to open more spread bets if she spots an opportunity in the markets. Mark cannot make further trades as he has used almost all of his money.

This is one of the great advantages of spread betting compared to normal share dealing; leverage allows small account holders access to the financial markets.

2. Using borrowed money from your spread betting provider

In Sally’s example above, she is borrowing £7,960 from her spread betting provider (£9,950 – £1,990 = £7,960) to gain exposure to £9,950 worth of shares. This happens with every type of spread bet: shares, commodities, currencies or any market your spread betting provider quotes a price for. The amount you borrow depends on each spread betting provider’s margin rates.

“The amount you borrow depends on each financial spread betting provider’s margin rates.”

In our example, we used a margin rate of 20% but you will need to check with your provider what rates they will quote you.

Margin rates will also depend on the type of company being quoted. Mark and Sally’s portfolios contain FTSE 100 companies at the time of writing.

You can expect margin rates to be low on these types of large companies. If they are smaller companies such as on the AIM market, you should expect margin rates to be higher.

3. An extremely low interest rate

In exchange for borrowing from her spread betting provider, Sally will be charged a small finance fee. Each spread betting provider charges different rates but they are usually so small they are barely worth thinking about.

For example, a well known spread betting firm charges daily interest on a FTSE 100 stock at LIBOR 0.5% plus a ‘loading adjustment’ of 2.5% per annum. This works out at 0.5% + 2.5% divided by 365 = 0.008% per day. These small amounts vary, but do check the terms and conditions before signing as a new client.

“The finance cost for spread betting is so low, that it is still a cheaper alternative to traditional share dealing.”

Generally speaking, the finance cost/interest rate for spread betting is so low, that it is still a cheaper alternative to traditional share dealing as we have seen.

The Dangers of Leverage

The advantages of leverage are obvious: getting more (exposure) for your money and freeing up your cash for further trades are two that immediately spring to mind. But what are the disadvantages?

The main disadvantage to leverage is that some (losing) traders do not understand how leverage works; just because you only pay the spread betting firm a fraction of the real cost of trading, does not mean that fraction is all you can lose on each trade. Be aware that you can lose more. Much more.

Let’s compare Mark and Sally’s portfolios again to explore this further. Below are purchases made by our traders. Notice how Mark has paid the full amount for his shares at £4,000 and that Sally has only paid £800 margin to get the same value of exposure as Mark.

If the price of Vodafone goes down by half to £5.00 a share and they both sell at the new lower price, then Mark and Sally will each lose £2,000. Let us see how this will effect their portfolios:

Mark purchased 400 shares costing £4,000 and now sells them for £2,000, losing £2,000. Sally purchased a spread bet costing £800 (margin) for £4,000 worth of shares and sells her spread bet for half the original price, she also loses £2,000.

Notice how Sally loses the same amount of money as Mark even though she did not spend the same amount of money as Mark on her Vodafone trade; as we have seen, leverage allows you to purchase a larger amount than would otherwise be possible.

Sally’s purchase price (margin) of £800 was overtaken by her loss of £2000. Mark actually gets back £2000 into his account but sally loses her margin (£800) and an extra £1,200, a total of a £2,000 loss.

What if Sally had used all the cash in her account on margin? And what if her entire portfolio fell in value by 50%? She will lose more money than is actually in her account making her a debtor!

Some spread betting firms have safeguards in place whereby they will close your spread bets automatically to prevent this from happening, but they cannot guarantee this; if markets are extremely volatile and moving quickly it will be difficult for your spread betting firm to close your spread bets.

Being a debtor and owing your spread betting firm money is not a situation any trader would want to find themselves in but it can and it does happen because traders fail to understand the nature of margin i.e. they buy too much. The lesson here then is to not to buy too much exposure and to remember how leverage works.

The question of how much exposure to buy or how to go about formulating risk management techniques is beyond the scope of this work; an entire e-book could be dedicated to this question.

In fact, in the near future, I expand on this very topic because risk management (how much) is more important to success in the markets than entries (when to buy) and exits (when to sell).

I am not alone in the belief that risk management is more important to a trader than entries and exits; if you do some reading, you will find that successful traders come to the same conclusion.

Often these traders will quote position sizing or volatility as means by which they can reduce the risk of losing. In regards to not buying too much exposure, some traders will determine the amount of money that they are prepared to lose before each and every trade using well known formulas and stop losses.

I have a policy of tieing stop losses on every single trade and would not trade without them. The point is that at the very least, traders ought to be using stop losses to deal with the dangers of leverage.

If spread betting is so dodgy, why not just buy the shares?

Now that I have thoroughly convinced you that spread betting is the root of all evil, complicated and just too much to deal with, it would be a good idea to re-evaluate the advantages of spread betting.

The advantages to spread betting are:

- It is a business enterprise you can practice before committing any money to it

Search results from Google will yield a list of websites that provide demo spread betting accounts free of charge for as long as you like. In demo accounts you are able to trade the markets in exactly the same way as you would with real cash.

- No capital gains tax on profits

At the time of writing (May 2011), there is no capital gains tax to pay on the profits of spread betting unlike traditional share trading. Tax laws can of course change at any time.

- No stamp duty to pay

Shares are charged 0.5% stamp duty on any purchase of shares. Mark would have had to pay the Government £20 for the privilege of investing in Vodafone in our example above.

- Leverage

If you know how to use it, leverage gives small account holders access to the financial markets unlike traditional share trading.

- Shorting

Unlike traditional share trading, you can make a profit on the value of shares going down instead of up if you use a spread betting account.

- No commissions to pay

As we have seen, commissions can vary in price between traditional stock brokers. Commissions can mount up as a significant cost, especially if you are an active trader.

Spread betting successfully requires good risk management, patience and time.