Pros

- Globally regulated (FCA, ASIC, FSCA, SCB)

- 2,500+ Financial Instruments

- Easy-to-Use Trading Platform

- Fixed Spreads on their Web Platform

- Very tight, competitive spreads

Cons

- No MetaTrader 5, Only the MetaTrader 4 is available.

- Slightly limited range of stocks you can trade on.

- UK traders can’t use the rewards program due to regulation

Trade Nation is a trading name of Finsa Europe Ltd in the United Kingdom and Finsa Pty in Australia, and the company is fully regulated in the United Kingdom, Australia, the Bahamas and South Africa. The company was originally founded in 2014 as Core Spreads and in 2019 re-branded as Trade Nation to appeal to a more international audience.

The provider offers Spread betting and Contracts for Difference (“CFDs”) on more than 2,500+ markets covering Currencies, Stocks, Indices, Commodities and Bonds from its inhouse, feature-rich and easy to use Trader Nation web trading platform, as well as the popular MetaTrader 4 platform. They refer to spread betting as spread trading but it is essentially the same – they are just trying to change the terminology to ‘trading’ rather than ‘betting’.

- Fixed spreads (Variable spreads on MetaTrader 4).

- Access to multiple markets including Forex, Stocks, Indices, Commodities and Bonds

- Low minimum stake size is 50p on most instruments, although they offer 10p per point on a few larger US stocks.

- Spread Trading on the Trade Nation platform

- CFD Trading on the MetaTrader 4 platform.

- No minimum deposit is applicatble.

Trade Nation offer fixed spreads with no hidden extra fees and variable spreads on MT4. The spreads themselves are very tight. Everything is laid out clearly and there is complete transparency on how much it charges in financing fees and spreads.

What Trading Platforms are available at Trade Nation?

Trade Nation offers clients its in-house web-based trading platform as well as the popular MetaTrader 4 platform. Trade Nation offer a standalone web-based platform which can be accessed via desktops or on mobile devices. It is fully customisable for users’ preferences. It has an advanced charting package that includes 12 interactive graph types like histograms and candlesticks. It is also very easy to customize charting timescales from one minute to one month and overlay information on graphs, with a selection of drawing tools available. Trades can even be executed directly on charts for those who are highly focused on technical analysis or want their trades to be executed fast.

The web platform is intuitive and easy-to-use but lacks some of the more advanced functionalities of MetaTrader. The mobile versions are available from Google Play and the Apple Store.

Trade Nation Web Platform

- Simple and easy to use interface.

- Smart news.

- Interactive Graphs.

- No download needed.

Trade Nation also provides the popular MetaTrader 4 platform, but this is only aimed at those trading CFDs, not those spread betting on margin. Spreads on our MT4 are variable and start at 0 pips and they do not charge commission either so its quote a good offering. MT4 comes with one-click trading and advanced charting capabilities.

Trade Nation MetaTrader 4 Desktop

- Variety of technical tools and indicators.

- Multiple order types.

- One-click trading.

- Advanced charting capability.

What are the Spreads Offered by Trade Nation?

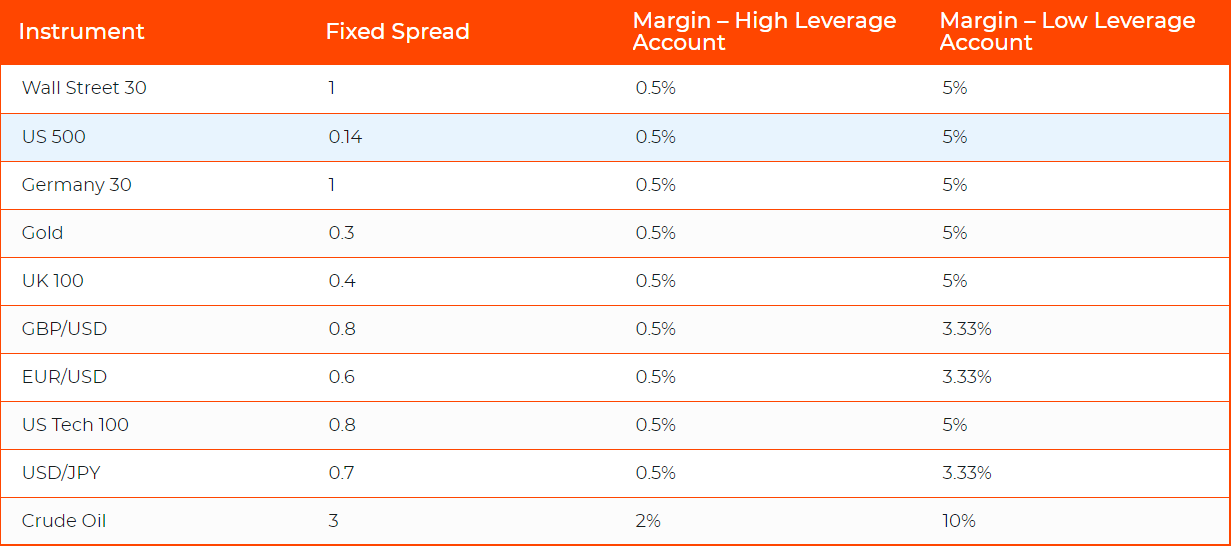

Trade Nation claim to offer low fixed spreads and their trading platform quoted us a EUR/USD spread of 0.6 pips. Spreads vary according to the underlying financial instruments being traded with spreads starting from 0.6 pips on the EUR/GBP, from 0.9 pips on the USD/CAD, and from 1.4 pips on the AUD/CAD. A commission of $1.80 is applicable per standard lot per side, so the pricing is indeed attractive.

Note that although the spreads are fixed, which means that they are not affected by market conditions, spreads on currency pairs may widen depending on the time of the day. There is a pdf document on the Trade Nation websites which details the spreads for each instrument, and highlights whether this applies at all times or changes throughout the trading day. This table also sets out margin percentages, minimum stake, and trading hours for each instrument, so it is very useful to have to inhand. See Market Info here: https://resources.tradenation.com/downloads/MIS.pdf

What Leverage is Offered by Trade Nation?

Trade Nation permits clients to trade on margin which requires clients to deposit only a small amount relative to the full exposure represented by their trade, as long as this deposit meets the margin requirements. Margin requirements are calculated as a percentage of the overall value of the trade, and are different for each instrument. The margin required will also vary depending on whether your account is classified as low leverage or high leverage, and the difference can be considerable. This depends on whether you’re classified as a retail or professional trader or which jurisdiction you open the account with as Trade Nation have several licenses including the UK (FCA), Australia (ASIC), South Africa (Financial Sector Conduct Authority in South Africa) and the Bahamas. If you’re located in the UK or Australia you will be limited to 30:1 leverage. Clients from other countries may be able to access leverage of up to 1:200 if they sign up with the Bahamas subsidiary.

What Markets are Offered by Trade Nation?

Trade Nation offers its clients the ability to trade on more than 2,500+ financial instruments. This includes 33 currency pairs, 23 popular indices (cash and futures), 8 differential indices, 9 commodities (energy and metals) and 3 bond options. Trade Nation offers trading in individual equities and indices, with a good range of UK, USA, European and Australian stocks available to trade. There are also a wide range of stock indices offered, including UK, USA, Asian, European and South African indices. These include the Hong Kong 50, Japan 225, Euro Stocks 50, UK 100, US Wall Street 30 and South Africa 40, amongst others. There is a good choice of indices you can trade with this provider, but individual stocks are more limited.

Below is a list of just some of the available markets that are available for dealing:

What Charting Analysis tools are offered by Trade Nation?

Trade Nation offer a smart newsfeed to keep you up-to-date with news and market data as well. The smart newsfeed consists of ‘alternative news’ compiled from independent sources and social media as opposed to the traditional data reported by companies themselves. They also offer a signal centre through FCA-regulated Acuit, that provides clients with with free daily trading signals on indices, commodities and currency markets.

What Educational Resources are offered by Trade Nation?

There are a number of handy video tutorials to help guide new clients with the web platform. Beginner guides on spread trading and CFDs are available. In addition a demo account is available where new traders can practice risk-free with £10,000 of virtual funds to trade with. The demo account is also accessible using Trade Nation’s app. Moreover, Trade Nation offers various news and analysis articles which can be filtered by various categories such as Market Snapshot, Premium Content, Market Updates, Inside the Broker and more.

What Support is Offered by Trade Nation?

If you experience difficulties, Trade Nation offers Customer Support via telephone which is available between Sunday 22:00 GMT and Friday 22:00 GMT. Live chat is also available on Trade Nation’s website.

Verdict: Trade Nation offers very competitive, fixed spreads for a range of markets and they do it while being transparent and honest. This spread betting and CFD broker is a good choice, particularly for customers new to the industry. Apply for a Demo Account by clicking here.

Note: Financial Spread Bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 78% of retail investor accounts lose money when trading CFDs with this provider.