You will find that I emphasize the importance of volume of trading, at least in those methods that reveal it. The whole point of looking at charts is to try and figure out the mood of the other traders and hence what they are likely to do – buy and push the price up, sell and have done with it, or whatever. I hope it is obvious that looking at the volume of trading, how many traders there are and/or how much stock is bought and sold, gives important clues to the mood, and how much enthusiasm there is for any particular security.

You can’t always get this information, and it is secondary to the price, so sometimes you will just use techniques of price analysis for your betting. For instance, the Forex market is run from so many different exchanges around the world, no one place can tell you how much interest there is in any particular currency pair. But such a large market – some people estimate that Forex trades amount to several trillion pounds per 24 hour period – the volume may not be as important an indicator as for a minor stock whose price can move in a distorted way if there are erratic volumes of trading.

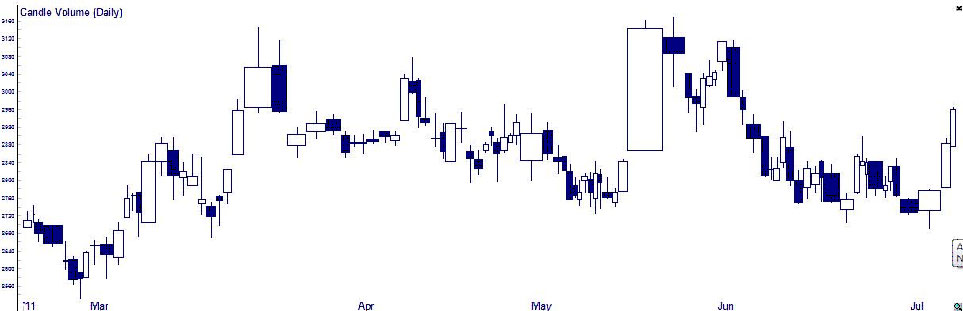

This leads to a variation of the candlestick chart was invented to give more graphic information, just as the candlestick chart is more graphic than the bar chart. The idea is to have the information at a glance to tell how important any of the candles are, by looking at the volume of trading. This is done by making the candles wider if there is more trading on any particular day, which makes them more noticeable. Here is an example: –

One of the first things to notice is that the time scale along the bottom varies. It has to, to accommodate the different widths of candles. In this case, there was a lot of trading in March, so that month is wider to show all the candle widths.

Usually you will see wider candles in the up-trends, but not always. If you see wide candles in down-trends, indicating that there is a lot of trading going on, then that is really significant, and a strong indication that market sentiment is against the security. The opposite is also true – if you see the price going up with little volume, or narrow bodies on the candles, then you know that the increasing price is not likely to go on for long, and doesn’t have much general support.