Tesco’s is one of the best known grocery store chains in the UK, and increasingly around the world, but its retailing is not limited to grocery goods. It is a British multinational retailer headquartered in Cheshunt, and is the third-largest retailer in the world by revenue, behind Walmart and Carrefour, the second-largest by profits behind only Walmart. It is listed on the London Stock Exchange, and is the 15th largest company with a valuation of approximately £24 billion.

It has been accused of various tax avoidance schemes over the years, mainly using offshore accounts, and details of these can be found in Private Eye. In its defence, Tesco’s has pointed out its duty to the shareholders to legally minimise expenses.

The company was originally founded in 1919, with the Tesco name appearing in 1924 from a combination of the initials TES of a supplier, and CO from the founder, Mr. Cohen. Originally operating from market stalls, the first shop was opened in 1929. The first self-service store was opened in 1956. Although in those early years of rapid expansion the focus was on retail grocery in the UK, in the last couple of decades Tesco’s has diversified geographically and into other sales, such as petrol, furniture, books, etc. It also has a financial division, Internet services, and other necessities.

There are six styles of store in the UK, of different sizes and offering varied goods. The largest hypermarkets are called “Tesco Extra”, and these include the largest retail store in England, in Walkden. These all include cafés and technical support. The next size down is the “Tesco Superstore”, a large supermarket. “Tesco Metro” is smaller, more like regular supermarkets and mainly in city centres. “Tesco Express” is a neighbourhood convenience store, and “One Stop” is smaller still, and run as a separate division. The sixth style is the “Homeplus”, a non-food store.

The company has been having some rough time in 2012 and 2013. Lack of investment in stores complacency and an over reliance on presence (by this I mean forcing themselves into every street in every town) I believe it will contract further with the increased competition from the European discounters and equally Tesco doesn’t cover the quality end of the market. But they are not going anywhere in the UK – we know how hard things have been for the British consumer since 2008. Tesco is 1/7 of the British consumer, £1 of every £7 spent in the UK. That they’ve held up so well is remarkable. They’re well entrenched here, the figures aren’t nearly as disappointing as many fear. But while Tesco has around 3000 stores in the UK, they also have about 3700 internationally. Looking 10 years out, it’s hard not to see that number expanding considerably, and spending in those stores (South Korea, Poland, Thailand, Malaysia, Turkey, China) increasing. I doubt Buffett will be selling any stock but they do need to up their game. I am unashamed to say last week I shopped at lidl and good quality, interesting produce is in several cases half the price of Tesco ranges.

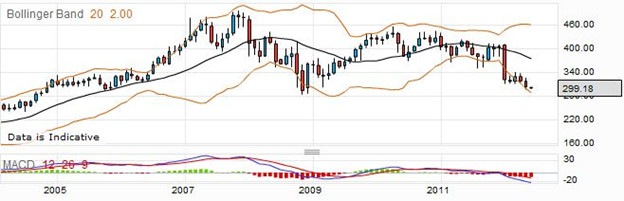

This monthly price chart shows good activity, and a tradable stock, currently facing a downturn.

Spread Betting Tesco Rolling Daily

Tesco’s is one of the best-known supermarket chains, and has diversified its range of offerings in the past few years. The current price for a rolling daily spread bet is 298.95 – 299.55. This is a fairly low number, which means that your stake per point may be proportionally higher. Suppose you think that the share price will go up, you might choose to wager £22 per point on this expectation.

If you are correct, and the price goes up, you may choose to close your spread trade and collect your winnings when the price is 315.72 – 316.32. Analysing this bet, the starting price was 299.55, and the trade closed at 315.72. That means you have gained 315.72 less 299.55 points, which is 16.17 points. Multiplying by your bet size of £22, your winnings will be £355.74.

It is the nature of financial trading that many bets do not work out, so look at the case where the price fell instead of rising. Suppose the price went down to 284.36 – 284.96, and you closed your bet to cut your losses. The starting price was the same at 299.55, and this time the closing price was 284.36. The difference is 15.19 points. For your chosen stake, this is a loss of £334.18.

The stoploss order can be useful to help you keep the size of your losses down. Depending on the values you choose, you can limit how much you lose before the bet is automatically ended for you by your broker. In this case, perhaps a stoploss order would have helped and closed the bet when the price dropped to 291.50 – 292.10. The bet would have closed at 291.50, which is 8.05 points down from the starting price of 299.55. Multiplying by £20, you would have lost £177.10.

Tesco Futures Based Spread Bet

The current spread betting quotation for a mid-quarter futures based bet is 299.08 – 301.48. This bet expires in four months, but with any futures style bet you can close it at any time, when you choose. You might consider that the price will go down in the next few weeks, and place a short or sell bet on this stock at a price of £25 per point.

As a first example, perhaps you will be proved correct and the price will go down to 276.54 – 278.68, at which point you will decide to take your profits. To work out how much you have won, first decide how many points you have gained. As this was a short bet, it opened at the lower price of 299.08, and then closed at the higher price, this time 278.68. 299.08 minus 278.68 is 20.40 points. You staked £25 per point, therefore you have won £510.

You must also consider the alternative, that you may have lost with this bet. Perhaps the price went up to 316.96 – 319.32, and you decided that you had to close the bet and cut your losses. Your starting price is the same, at 299.08, but this time the bet closed at 319.32. 319.32 less 299.08 is 20.24 points, which at £25 per point is a loss of £506.

One method that can help in reducing your losses is to place a stop loss order when you make your original bet. This requires your broker to close your losing bet when it reaches a price you specify, and saves you having to log in and check the market all the time. Suppose a stoploss order would have closed your bet at 308.03 – 310.41. The closing price was 310.41, so taking away the starting price of 299.08 you have lost 11.33 points. At your chosen stake, that amounts to £283.25.