Vodafone is a British multinational mobile telephone company, head-quartered in London. It is the second-largest mobile phone company in the world, and has between four and five million subscribers in over 30 countries. It is the second-largest company on the London Stock Exchange, with the capitalization of approximately £90 billion.

Vodafone had its origins in Racal Electronics in the 1980s, which company was involved in military technology. In 1982 Racal won a licence to set up a UK cellular network, and Vodafone was launched in 1985. Its operations were separated from Racal electronics in 1991. It has made acquisitions and partnerships in many countries, expanding its mobile telephone market, and this includes owning 45% of Verizon Wireless, a major US provider.

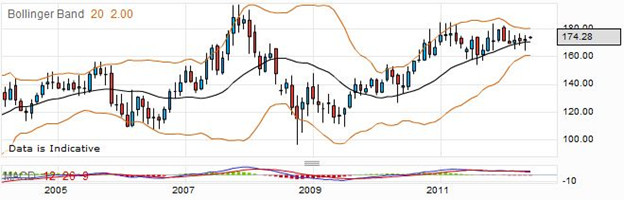

For such a large company, you can see that the share price has been very volatile. Aside from the decline from 2008 to 2009, which happened to many companies during the global economic crisis, there have been many ups and downs. There has also been criticism of the way Vodafone operates, with aggressive tax avoidance schemes routed through Switzerland and Luxembourg. One such scheme resulted in an exceptionally favourable negotiation with the taxation authorities, saving Vodafone billions in unpaid taxes, after which the senior taxation official who agreed the deal left government employment to work for Vodafone as its head of taxation. This episode resulted in street protests outside Vodafone outlets, and may have been part of the drop in value at the start of 2011.

For the spread better, such incidents must serve as a warning about the volatility that you may encounter. The chart is not for the faint of heart, and despite the size of the company as you can see the share price can move radically. However, if you have a sound spread betting strategy to avoid undue losses, the volatility can be a source of profit.

Spread Betting Vodafone Group Rolling Daily

As one of the largest mobile telephone companies in the world, Vodafone has many customers in numerous countries. If you think that the share price is going to go up, you may be interested in placing a buy spreadbet on the rolling daily, which is currently quoted at 173.48 – 173.82. With the rolling daily bet, you may be charged a small amount each evening when the bet is rolled over, but this amount is usually not significant unless you hold the bet open for weeks or months.

Assume you bet £20 per point, as the value of the Vodafone shares is fairly low and you may not expect much point movement. If you are correct, you may choose to close your winning bet when the price goes up to 198.61 – 198.95. As this was a buy or long bet, it opened at the buying price of 173.82, and closed at the selling price of 198.61. Working out the point difference, 198.61 minus 173.82 is 24.79, and multiplying by £20 you find that you have won £495.80.

Of course your bet may not have succeeded, and the share price might go down. Say it went down to 154.32 – 154.66. In this case you have lost 173.82 less 154.32 points, which is 19.50 points. At your chosen stake of £20, this is a loss of £390.

Many spread betters make a habit of using a stop loss order to help them close losing bets in a timely manner. If you had used one in this case, perhaps the bet would have been closed for you when the price was 162.16 – 162.50. The starting price was, as before, 173.82. This time the bet was closed at 162.16. The difference in points is 11.66 points, which at £20 per point is a loss of £233.20.

Vodafone Group Futures Style Bet

For a spread bet that may last for a few weeks or months, you may decide to place a quarterly future style bet. The current price for the far quarter for Vodafone is 173.71 – 175.80. Should you believe that the price going down, you might choose a short bet, selling at 173.71 with a stake of £15 per point.

First consider that you may be correct, and the price falls after you placed the bet. Perhaps the price will go down to 146.23 – 148.30, and you will choose to close the bet and collect your winnings. The bet was opened at the selling price of 173.71, and closes at the buying price of 148.30, giving you a difference in points of 25.41 points. Multiplying this times your stake, you find you have won £381.15.

Secondly, your bet may have failed, with the price going up after you placed it, and you may have to close your spread trade and accept your loss. Say the price goes up to 193.01 – 195.05, and you close the bet. As it was a short or sell bet, it closes at the higher price of 195.05. Taking away the starting price of 173.71, you have lost 21.34 points. At £15 per point, that would cost you £320.10.

Finally, you may choose to place a stop loss order when you open your bet. This would make sure that even if you could not get to your computer, if the bet went against you by a certain amount your spread betting provider would close it and stop any further loss. Perhaps in this case the bet would be closed at 186.24 – 186.60. This time the closing price would be 186.60. With a starting price of 173.71, you would have lost 12.89 points. For your chosen stake, this would amount to £193.35.