There are various ways to trade on the commodity of sugar in the spread betting market. A popular one is to bet on exchange traded commodities, or ETCs, although you can find bets on future contracts on both the London and New York futures exchanges.

Sugar is produced from both sugarcane and sugar beets, and sugarcane accounts for the majority of the production. Cane is grown in Brazil, China, India, and Thailand; the largest areas for beet production are Europe, the USA, China, and Japan.

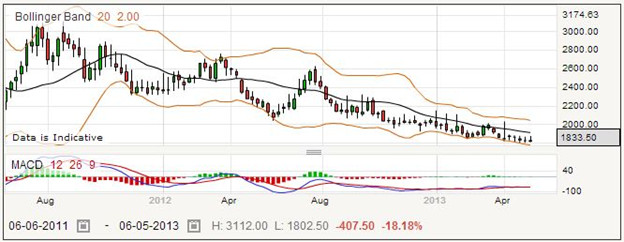

You can see from this weekly price chart on the ETC that the price of sugar has been generally falling. Sugar has been facing competition from sweeteners such as high fructose corn syrup. However, to counter this reduction in demand, you should know that Brazil has been using sugar to produce ethanol since 2006, and this has helped to keep the price up. It also means that the price of oil can impact sugar prices, because of the trade off between the markets.

In fact, Brazil is highly influential on the sugar market, as it is the largest producer and exporter of sugar. Bad weather in Brazil can impact the global price of sugar significantly. In the normal course of events, the cycle of the crop leads to an increase in sugar prices from August to November, which you can see to some extent in the chart above.

Sugar prices are not a totally free market. The countries where sugar is produced consume most of their own production, which may also be subsidised by the respective government. This means that countries which need to import sugar to supplement their supplies, such as Russia, the USA, and the European Union countries, will have the most impact on the world market.

The price chart above shows pretty good adherence to the MACD indications, and much lower volatility in recent months. However, these contracts are readily traded for a profit on a daily basis.

Sugar Rolling Daily

The rolling daily price for sugar as an exchange traded commodity is quoted at 1829 – 1838. Supposing that you are bearish on the price of sugar in the coming weeks, you might choose to place a short spread bet which would be at the selling price of 1829, staking £3 per point.

For an example, assume that the price drops as you anticipate, and you are able to close your bet and collect your profits when the price reaches a level of 1543 – 1552. That means that your short bet closes at 1552. Taking this away from the opening price of 1829, you would have gained a total of 277 points. You chose to wager £3 per point, so you can simply work out that this is a profit of £831.

Supposing however the price went up after you placed your bet, and you decided to accept the loss when the quote reached 1972 – 1981, before it got any higher. This time you have lost 1981 minus 1829 points, which is 152 points. For your chosen size of stake, this works out to a loss of £456.

Unless you are prepared to sit at your terminal all day long, it is easy to let a losing position grow too large before you realize it. That is why many spread betters utilize a stop loss order which requires the spread betting provider to close a losing position after it reaches a certain level. In this case a stoploss order might have closed your trade earlier, say when the quote was 1914.8 – 1923.8. This time the losing bet would close at 1923.8. Taking the starting price of 1829 away from the closing price, with the stop loss order your loss would be 94.8 points. As you decided to bet £3 per point, this would cost you £284.40.

Sugar Futures Style Bet

If you want to trade on where the price will move in a few weeks or months, you may choose to place a future style bet which requires no daily rollover, but expires at a set date several months away. Even though there is a set date, you can still close this type of bet at any time, either to lock in your profits or to limit your loss. The current quote for the far quarter futures bet on ETC Sugar is 1835 – 1847.

Suppose you think the price is going up, and establish a long position with a stake of £1.50 per point. For a buy bet, the opening price is the higher number, in this case 1847. After some time, you may find that the price goes up to 2264 – 2276, and decide to close the trade and collect your profit. The spread bet would close at 2264, so taking away the opening price you would have gained 417 points. Multiplying by £1.50, the total winnings amount to £625.50.

If things didn’t work out, and the price fell, you could choose to close the trade when the price was quoted at 1692 – 1704. The closing price this time is 1692. 1847 minus 1692 is 155 points, so at a stake of £1.50 per point your losses amount to £232.50.

You might have done better if you had placed a stop loss order when you took out the trade, as this would close the losing trade as soon as your pre-decided level was reached without you having to take any action. With a stop loss order, perhaps this losing bet would have been closed at 1749.2 – 1761.2, making your closing price 1749.2. Taking this away from the opening price of 1847, this time you would have lost just 97.8 points. At £1.50 per point, that works out to £146.70.