Pepperstone is a UK, FCA regulator provider that offers both spread betting and CFD trading. Pepperstone offers its clients with a choice of three trading platforms. MetaTrader 4, MetaTrader 5 and cTrader.

The MT4 platform is of course the industry standard and this is available for Mac, iPad/tablet, Android and iPhone. A web-based MT4 version is also offered, called Web Trader. The MetaTrader 4 trading platform is very popular with traders. It is fairly user-friendly and comes with charting functionality, a Market Watch Window, a Navigator Window, basic order types, 85 preinstalled indicators and good analysis tools. MetaTrader 4 (MT4) also supports expert advisors and other automated trading strategies.

There is also support for MetaTrader 5 which has faster processing execution speeds, 38 built-in indicators, 21 time frames, a built-in economic calendar, advanced pending orders, and the ability to hedge positions.

With cTrader, you get a solid trading platform with fast execution and top-tier liquidity. cTrader was designed by traders for traders and has a user-friendly interface that is easily customizable to your preferences. The cTrader platform includes detachable charts, level 2 pricing, good backtesting facilities, automated trading via a dedicated platform, and next-generation charting techniques and user interface. A web version of the cTrader trading platform is also available, as well as platforms for mobile devices.

Disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 78.6% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Pepperstone Razor Account

The Razor account is suitable for advanced an EA traders and offers very tight spreads but with a small commission on top. As regards the spreads offered, they start from 1.2 pips on the EUR/USD standard account and 0.8 pips on the Razor account. Pepperstone also charges commission on the Razor account, amounting to $3.5 per 100k traded, while the Standard one is commission-free.

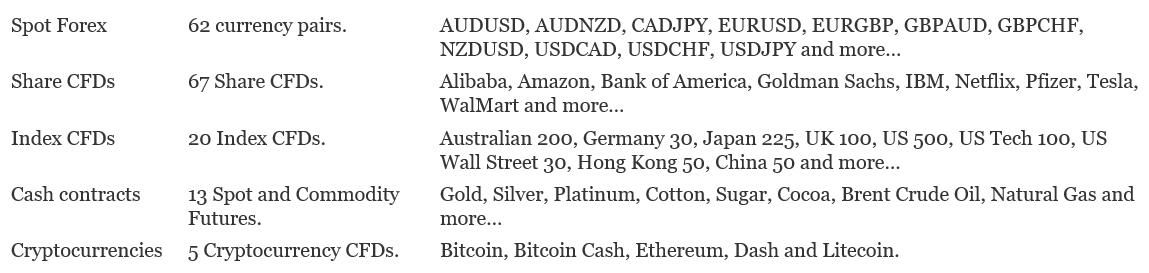

With Pepperstone you can trade as many as 62 forex currency pairs. Major pairs have of course the tightest spreads but Pepperstone claims to offer very high-quality execution, low latency and a reliable trading structure. In addition to forex pairs with Pepperstone you can also trade indices, stocks, commodities, precious metals and cryptocurrencies. There are 6 precious metal pairs available, including gold, platinum, silver, and palladium against the USD or EUR. As regards oil markets you can find both Brent Crude Oil and West Texas Intermediate Crude Oil, as well as natural gas and more here and the minimum trading size is 10c per pip. If you are interested in cryptocurrencies, Pepperstone quotes Bitcoin, Ethereum, Bitcoin Cash, Dash, and Litecoin, each against the U.S. dollar. This permits you to trade those cryptocurrencies without actually have to buy them outright or keep a cryptocurrency wallet.

Markets: The markets in which traders can participate in are extensive and include; over 62 forex currency pairs, 20 major global stock indexes, 67 individual US equities, 6 precious metal pairs, oil and gas commodities, and 4 cryptocurrency CFDs.

Minimum deposit: No minimum deposit, but Pepperstone recommend a minimum of $500/£500.

Three types of accounts: Pepperstone offers 3 account types; namely Spread Betting, Standard and Razor. Spreads are tighter on the Razor account than the Standard one. All Pepperstone accounts allow scalping, trading robots, and hedging.

Demo account: A demo account that comes with $50,000 dummy funds is available for practice and is available for 30 days.

Is Pepperstone an ECN/STP trader or market maker? ECN and STP are basically marketing terms and different providers in the industry give them different meaning. A ‘true ECN’ or STP broker is simply an introducing broker or a broker who operates using someone else’ system under a white label arrangement. Pepperstone are the issuer of the products they provide so they have control over the system that they use. Having said that, Pepperstone can be considered to be an ‘ECN’ broker in that they don’t run any proprietary trading book but source their pricing from external Liquidity Providers via an electronic communication network, and this pricing is passed onto clients without a dealing desk intervening.

All in all I like Pepperstone and what they offer. They are a serious provider and they are one of the few providers that offer spread betting on MT4, MT5 as well as the cTrader platform.