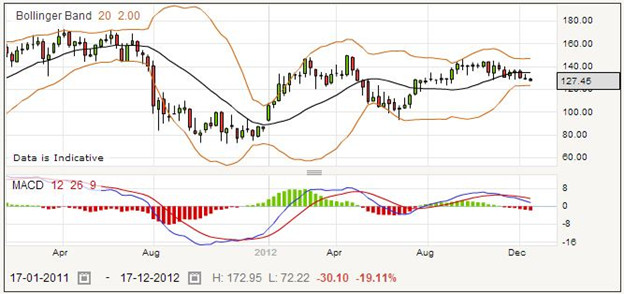

Afren is an independent oil exploration and production company, and if you have been spread betting for any time you will know that means that you can expect a volatile price, as you can see in the weekly chart below.

The company operates mainly in Nigeria and is relatively young, having been founded in 2004. Its other oil fields are located around Africa. It was floated on the London Stock Exchange in 2005. It currently counts 29 assets in 12 different countries, and boasts strong growth, although as you can see the price has been both up and down in recent months.

The Middle East and Africa focused oil explorer and producer Afren is expanding rapidly and in 2012 its oil production was over 40,000 barrels of oil equivalent per day. It has operations in two oil fields which are off the coast of Nigeria; and these alone produce 22,000 barrels of oil equivalent per day. It has further fields it is developing, such as the Ebok, another offshore Nigerian field, which it is still developing although there is some production.

When you spread bet on an oil company, you are exposed to several different types of risk. You may be familiar with the way that oil futures prices can fluctuate, and this inevitably impacts the share prices of oil companies whether or not it should. The world maintains a balance between oil production and consumption, so any little change in either side can have large price effects.

Another type of risk is the chance that you take on a particular oil company, especially one which is relatively small and reliant on a few oil fields in a specific region, such as Afren. Political upheaval can impact prices, as can good or bad reports on the fields that are being worked.

In summary, you can expect prices to be volatile and therefore capable of yielding good profits, but you need to take care to protect yourself against losses.

Spread Betting Afren plc Rolling Daily

Afren is a volatile stock, and should give you plenty of opportunity for profit even though you must be careful to avoid large losses. Say you think that the price of the stock is going down, you might be tempted to place a short or sell bet. The current price for a rolling daily bet is 127.38 – 128.02. Perhaps you would stake £16 per point on a short bet at the selling price of 127.38.

For a first example, assume that the price goes down as you had hoped, and you decide to close your bet and collect your winnings when the quote reaches 107.63 – 108.27. Your bet would close at the buying price of 108.27. That means you have gained 127.38 minus 108.27 points, which works out to 19.11 points. Multiplying by your stake of £16, your total winnings are £305.76.

Secondly, assume that you did not win and the price went up after you placed your short bet. You might close your bet and accept your loss when the quote went up to 141.21 – 141.85. This time your closing price would be 141.85, and that is 14.47 points higher than your starting price of 127.38, therefore you have lost 14.47 points. For your size of wager, that works out to £231.44 lost.

What many spread betters do is take out a stoploss order when they open their bet. This saves you having to watch the prices all the time, as your spread betting provider will close a losing bet for you once it reaches a certain trigger level that you set. In this case, with a stoploss order the losing bet might be closed earlier at say 137.26 – 137.90. This time the closing price would be 137.90, so taking away the opening price of 127.38 you would have lost just 10.52 points. With a stake of £16 per point, that works out to a loss of £168.24.

Afren plc Futures Spreadbet

A futures style bet can be held until the expiration date, with no rollover charges to your account, so is suitable if you think the stock price will move, but are not sure if it will take a few weeks or months to go in the direction you hope. Say you think that Afren shares are going up, you could place a far quarter futures bet for £12 per point. The current quote is 127.57 – 129.11.

Consider first that you have made a winning choice, and that the quote goes up to 157.20 – 158.74. You can work out how much you have won like this: –

- Your bet was placed at 129.11

- Your bet closed at 157.20

- Therefore you have gained 157.20-129.11 points

- Which works out to 28.09 points

- Your stake was £12 per point

- Therefore you have won 28.09 times £12

- A total of £337.02

It is difficult to predict the markets, and you might find that the price goes down to a level where you feel you must close the bet and accept your loss. Say this happens when the quote is 103.87 – 105.41.

- Your bet was placed at 129.11

- Your bet closed at 103.87

- Therefore you have lost 129.11-103.87 points

- Which works out to 25.24 points

- Your stake was £12 per point

- Therefore you have lost 25.24 times £12

- A total of £302.88

Once again, you might choose to place a stoploss order on this bet, so that your spread betting company will close the losing trade for you. With a stoploss order, say the bet closed when the quote was 109.80 – 111.34.

- Your bet was placed at 129.11

- Your bet closed at 109.80

- Therefore you have lost 129.11- 109.80 points

- Which works out to 19.32 points

- Your stake was £12 per point

- Therefore you have lost 19.32 times £12

- A total of £231.78