Spread Betting on Gold and other Metals

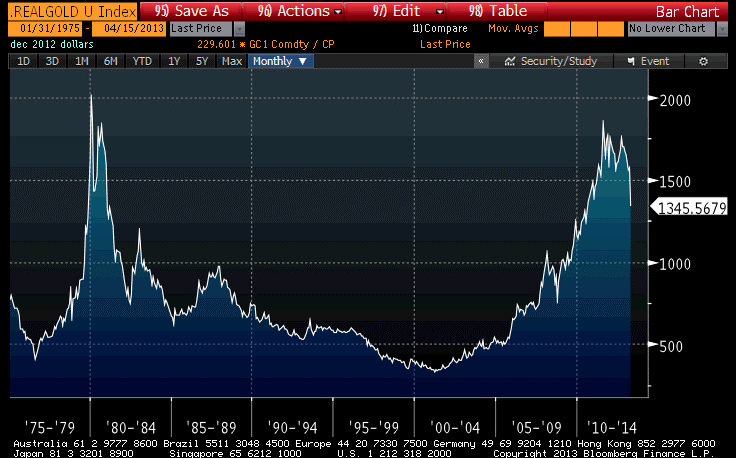

GOLD is at an all-time high. It’s not of course – taking inflation into account, an ounce was $2300 and change back in 1980. But does it matter? The big issues of the day are inflation and economic recovery; the gold story is a corollary to this. Of course from a short-term trading perspective we don’t really care whether the fundamental story for the bull run on gold is true or false; we can take a view either way without too much chin-scratching.

Financial spread betting is feasible way to get exposure to the gold price as well as other precious metals including gold, silver, platinum, palladium and copper since you benefit from price movements without having to take ownership to the underlying assets. The recent upswing in gold prices coupled with global economic jitters and a falling dollar can mean a bounty for spreadbetters.

The Fundamentals

DID YOU MISS the 21st century’s biggest bull market to date? Gold has risen from around $250 per ounce in 2001 to a 2012 high of $1917.90, while silver has risen from around $5 per ounce in 2001 to a recent high of $49.81. Mainstream pundits began calling gold a “bubble” in early 2008, but it confounded the naysayers and rose further that year – and again in 2009. in doing so, it racked up gains that outpaced the Us stock-market’s longest stretch of year-on-year gains (1982-1989) and also beat every other major asset-class hands down since 2000.

Of course, the ride upwards has been erratic. Silver in particular has fallen considerably from this peak… but over the long term the profits have been undeniably handsome.

The price of gold is driven mainly by supply and demand as well as speculation – however unlike most commodities ownership of gold is more significant than its consumption and for most investors gold is by itself money although in practice there is not a sufficient amount in circulation to function as a currency medium of exchange.

So what’s been driving Gold’s long-term rise in price, and what’s the best way for active traders to play it? Gold is no longer legal tender but due to the collapse of faith in sovereign debt obligations particularly fiat currencies and paper monies and a distrust in governments and financial institutions, gold is increasingly becoming an important banking asset. Gold is unique and universally accepted; in fact gold lead the way to the concept of money itself: portable, private, and permanent. There is not much new gold reaching the global economy and it has been used for many centuries as currency; it doesn’t corrode or get wet and is accepted anywhere in the world. With very little effort gold can be switched into local currency or property or anything if you prefer. The same cannot be said of different currencies or commodities. How you choose to buy, sell or short the commodity really depends on your outlook for those other, poor-performing, classes of asset. so far in the last few years, gold has risen substanitally investors, proving its “safe haven” status but also handing fast gains to quick-witted bulls, especially those using leverage.

“Gold, should be seen more as a store of value – it’s going to preserve your purchasing power, but it’s not really a way to make money, it’s a way to preserve the wealth you have already accumulated. Demand is pushing up against a growing shortage, investors are adding metals to hedge against inflation, and increased interest from traders and the broader market are all driving the prices of gold and silver up.”

Gold itself, however, doesn’t do much. sitting at No.79 in the Periodic table, it’s a mere lump of metal, prized for its beauty and rarity, and used by civilizations worldwide to store wealth for at least 5,000 years. expensive to mine (now around $950 per ounce according to top analysts GFms) and impossible to destroy (only cyanide dissolves it), gold has few industrial uses (just 14% of annual global demand) and pays you no interest. Since gold doesn’t come with a growing revenue stream or dividends it is often rejected as a viable investment. But while that makes it worthless on cashflow or price-earning metrics, gold is also unique amongst the major tradable assets in being nobody’s promise, and no-one’s to create. Hence the strong bid for gold amid deflation, as well as during strong bouts of inflation.

Gold is often seen as a hedge against money printing and actually benefits from low or negative interest rates (high inflation) as there is no opportunity cost of holding the metal. Better returns on cash deposits and tapering central bank quantitative easing would both put downside pressure on demand for the precious metal.

Why is gold precious? It is very dense which means that it is quite practical to carry and store. Actually, with gold one can just as well pack up and put all his wealth in a bag in times of crisis or other disaster. It doesn’t corrode so value remains intact with time and the supply of the metal is strictly controlled as no government can callously erode your savings by increasing production. It is also very liquid and is recognized globally allowing for flexibility and trust. Will Yuans or Rupees work this way?

So gold not only acts as a safe haven in hard times but it also preserves your purchasing power. In 1913 gold was US$20 an ounce. Today, the dollar has lost some 95% of its purchasing power and gold is trading at almost $1800.00 an ounce. Just think for a moment: in 1913, US$1000.00 would have allowed you to acquire some 50 ounces of gold (that’s $88,150.00 in today’s paper money). A thousand dollars today will only buy you 17 grams – just over half an ounce of gold. Because unlike a stock, bond or bank account, gold can never default – not if you own it. And unlike real estate, gold trades 24 hours a day in a deep, international market.

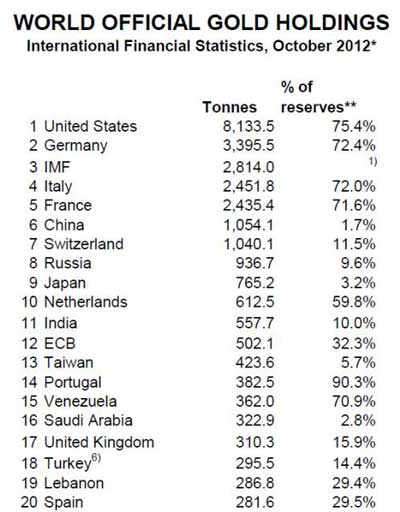

Central banks so, who’s got the gold today? thanks to Europe taking Gordon Brown’s lead a decade ago, central banks worldwide were net sellers until 2009, while some now have signalled their intention to buy gold in coming years. While most central banks continue to create their own fiat currencies, they have now also starting piling up gold in their vaults – even the International Monetary Fund has started acquiring more gold to reduce their risk exposure and diversify their holdings away from the dollar and other paper currency. Russia now heads emerging-economy buyers, but worldwide the governmental sector owns one ounce in six ever mined throughout history. Because gold is “the ultimate form of payment…it is always accepted,” as former Us Fed chief Alan Greenspan said in 1999. And even without Armageddon, gold offers “unparalleled security, liquidity and diversification,” in the words of a French central banker. This gold buying by central banks only helps to reduce the supply available to the world’s citizens.

The World Gold Council expects that global central bank purchases would amount between 450 and 500 tonnes in 2012. Notable in the list of nations where central banks have been net buyers include:

Mexico, Russia, Turkey (acquired 6.6 tons in August), China, Argentina, Bolivia, Kazakhstan (acquired 1.4 tons in August and another 8.5 tonnes in October 2012), Ukraine (bought 1.9 tons in August), Colombia, Venezuela, Thailand, Turkey (which increased its holdings in October 2012 by 17.5 tonnes), Belarus, Sri Lanka, Mauritius and Bangladesh.

Paraguay is one of the latest countries to have boosted its gold reserves from just a few thousand to over eight tons while the Banco do Brasil has increaseed its its gold reserves by 17.2 tonnes in October 2012 taking its holdings to a peak of 52.2 tonnes.

Meanwhile, South Korea has increased its gold reserved by 30%, from just 1.750 million troy ounces in June 2012 to around 2.260 million troy ounces in July – a 70 metric ton increase.

China continues to buy production from its own gold mines. It has also bought over two tons of gold from North Korea and in 2009 acquired four tonnes of gold from Hong Kong. In 2011 China is recovered to have purchased around 46 tonnes of gold ingots. It has been reported that gold imports from Hong Kong for the first 6 months of 2013 amounted to 16 million ounces, which is more than double the amount imported by China over the same period in 2012.

Likewise, Russia has increased its gold reserves from 29,516 million troy ounces in June to 30,113 million troy ounces. According to the World Gold Council (WGC) central banks from around the world acquired 254.2 tons in the first half of 2012 and the Council predicts that the figure might end up closes to 500 tons for all of 2012. On the other hand the European Central bank and USA have kept their reserves unchanged.

This central bank gold buying marks an important shift in policy since for the last 50 years central banks have mostly been net sellers of gold; with a change having been brought about in 1999 with the Central Bank Gold Agreement. The last 50 years of selling by central banks have obviously negatively impacted the gold market, however the new agreement restricted sales to 400 tons a year for the next five years. The increased global money supply and high level of systematic risk is driving countries to diversify their foreign reserves away from the USA dollar, Euro and other fiat currencies by acquiring gold.

Further economic unrest is likely to keep the demand for the metal high as central banks seek to continue loosing monetary policies to continue supporting their domestic economies. One only has to look at China to see how the country is trying to reduce its huge $3.24 trillion in foreign reserves exposure. China’s gold reserves are now more than 2,000 tons but this is still negligible as a % of its overall foreign exchange reserves – in fact it amounts to less than 2%. When you take into account that the USA, Germany, France and Italy have in excess of 70% of their forex reserves in gold it is to be expected that emerging nations’ banks will continue buying more gold.

The demand for gold depends to a large extent on investment demand. The metal is also used in medicine, technology and jewelry but this accounts for a smaller part of the global demand for gold. Unlike other fuel commodities like oil, gold isn’t destroyed when used and can be used over and over again without losing value. However, mining companies which supply the market typically experience high inelasticity to demand in that they aren’t able to easily adjust production to meet demand levels. In addition, proven gold deposits are limited and the sector requires substantial capital, requiring big investments in technologically sophisticated extraction systems. The preparation for a goldfield can take a number of years before ore can even start being extracted. Thus when mining companies aren’t able to keep up with demand, prices move up until demand subsides. Although the supply can also be affected by central banks selling their gold deposits or by sales by institutional investors, production is what determines the growth of the market in volume terms.

Global mined production is coming under pressure due to -:

- Declining grades

- Construction and commissioning delays

- Extreme weather

- Labour strikes

In other words global gold production is largely flat while costs for extraction and production are increasing. Declining ore grades are a serious issue and simply mean that there is less gold in a tonne of rock meaning that the mining company will have to process extra rock to produce the same amount of gold as before which raises costs.

While western fund managers are only just catching on, indian housewives have long understood gold to be a great investment hedge. Hoarding perhaps 16,000 tonnes of jewellery between them, they’ve seen gold beat the rupee in 28 of the last 40 years, trebling in price in the last half-decade alone. The peak demand for gold in India matches the Diwali festival season which makes up for around 40% of India’s annual gold demand. India remains the world’s No.1 consumer market curiously mainly not for industrial reasons but for cultural and religious beliefs, but mainland China is now close behind whilst also being the world’s largest producer. Private Chinese spending on physical gold has soared since de-regulation a decade ago, more than doubling to 2% of its huge household savings each year and far outweighing Beijing’s central-bank hoard. This increased demand for gold is supported not only by fears over inflation levels, but also by a population that has more money to spend. The demand for gold as an inflation-protected store of value and a perceived safe asset has an impact on gold prices. For instance, when the Federal Reserve in the USA decided that it would retain interest rates at a low level through 2014, gold rallied. For British and USA investors, in fact, gold has offered a neat play on China, showing a stronger correlation with the shenzhen stock market than with copper, crude oil or platinum since 2005, according to the World Gold Council.

Although gold investment is not openly encouraged by the government, it is available to proactive private investors. This trend will contribute to a shift in demand for gold on a global scale in the coming years. In developed markets, investors have traditionally used precious metals exposure as a safe asset in times of financial crises or a tight economy. Increasingly though, institutional investors consider gold as a long term capital growth asset. The lack of dividends or any other cash flows have kept gold out of the core assets of institutional investors’ portfolios. The consistent appreciation of the metal, most notably over the past decade, is turning the balance.

Gold Positives: Gold is unique in that it actually thrives from negative interest rates and is considered a hedge against money printing.

China upping its gold holdings to hedge against inflation. Jewellery demand is also increasing in the country and China is now the largest jewellery market for the metal. Gold has been viewed as a real asset and a global currency for thousands of years and its supply is strictly controlled. Moreover, countries around the world continue with their quantitative easing programmes. On the other hand governments can’t print gold or silver and no single government controls them, which is why these metals have retained their role as a medium of exchange for thousands of years. Just to bring this into perspective; the Federal Reserve via its latest QE3 initiative is creating about 55 million ‘new’ dollars into existence every hour yet the entire world’s gold mining companies are only capable of extracting about $100,000 worth of gold from the ground every hour – roughly speaking that’s about 10,000 new dollars for each dollar of newly mined gold. Global gold production is peaking as quality ore becomes harder to source without the use of new innovative exploration and extraction measures. Grades keep decreasing while operators continue facing challenging operating conditions, both in geopolitical and geographical sense.

Indian Budget – No mention of import duty on gold, however, the announcement of some very interesting developments in the monetisation of gold. There are to be Gold-Deposit accounts which will earn interest. Also, Sovereign Bonds based upon gold and paying a fixed-rate of interest, redeemable for cash based upon the face-value of gold. The minting of their own gold coinage which will diminish the need to import same – so, unless I’m misreading it, these initiatives are a big step towards the monetisation of gold and its use as currency. This could be a game-changer. In India, gold can now earn interest. This must be a first and probably a pointer towards the plans of other countries. I’m thinking China and Russia. Edit: – Apparently there is approx. 20,000 tons of gold circulating in India and the Govt. is seeking to put it to work. – Leaving the import-duty in place will act as a deterrent towards the importation of gold and as an incentive to use the gold they already have. It will be interesting to see how it develops. A perpetual cry of the ante-gold camp has been that it doesn’t pay interest. Well, providing the budget is passed, it does in India. This could be the thin-edge of the wedge. Gold as a currency in as powerful a global player as India could have a big influence on world economics. I can’t see it as being good for the dollar.

Gold Negatives: Increasing returns on bank cash deposits or less central bank quantitative easing would reduce demand for gold.

With all the uncertainty/economic problems/wars going on in the world, the price of gold is still mostly stuck – Ukraine – Syria/Iraq conflict- rock bottom interest rates – massive Quantitative Easing and money printing – what else does one expect for Gold? A big decline? It’s not the news which drives price trends; it’s the behaviour of buyers and sellers and these cycle according to psychology.

India, whose population traditionally has always had a big appetite for the metal experienced lower demand as high prices discouraged prospective buyers while the introduction of import taxes and government controls have also curbed appetite. The World Gold Council is forecasting total gold commodity imports at about 305 tonnes in the second half of the 2012 which is substantially less than the comparable period of last year’s (2011; 380 tonnes) due to mainly increased domestic scrap sources. It is worth noting here that the movements of the Indian rupee also impact the demand for gold. For instance when the Indian rupee appreciated some 3%, gold prices plunged locally despite a dramatic rise in the gold price globally. Some analysts also believe that gold is no longer a hedge but has become a tradable commodity which speculators are buying and selling just like any other stock or exchange traded fund – just as they do with a stock like Apple meaning that investors are more prone to taking profits when the price of gold rises. If the Federal Reserve decides to taper its quantitative easing, gold will weaken.

The relationship between gold prices and the US dollar has been consistently inverse. At times of a weak US dollar, gold and other precious metals have consistently shown an upward trend. Gold, as a commodity with strictly limited supply, is priced in terms of a currency, which is subject to monetary policy manipulations. Because such commodities are denominated in USA dollar, the price of gold is prone to rise when the USA dollar weakens and fall when the USA dollar strenghtens, all other things remaining equal.

The monetary and fiscal stimulus programs that governments all over the world introduced in response to the economic recession, precipitated by the financial crisis of 2008, have increased liquidity and monetary aggregates. Most notably, the quantitative easing program of the Federal Reserve made capital available and cheap at a near zero interest rate level. The demand for gold moves in the opposite direction to interest rates; the higher the interest rate, the lower the demand for gold, the lower the interest rate, the higher the demand for gold. The Fed’s promise here to keep interest rates ultra low until 2015 is likely to give further support to the gold price.

In an environment of low interest rates, the opportunity cost of holding gold, which does not bear dividends or interest, is relatively low. The ensuing inflationary pressure is an inevitable byproduct of this policy, as it targets a renewal of economic growth. A traditional function of gold has been as a hedge against inflation within a diversified portfolio due to the perceived quality of the metal to achieve higher-than-inflation returns, despite economic difficulties. Increasing fears of inflation pushed more investors to expand their holdings of gold, causing a powerful shift on demand for gold. The rally of gold prices over the past two years was to a great extent due to the fear of and protection against inflation. This is because gold is a proven investments to offer a better return than inflation due to its rising price in the long term (or at least not a loss of purchasing power). Of course when real interest rates are rising, gold prices can fall quite quickly but generally speaking rates below 2% are favourable for gold. Consider for a moment that the Fed’s interest rate is presently at 0.25%; such negligible returns on cash make inflation a serious threat for savers and this drives investors to hunt for instruments to preserve their wealth.

Re-establishing stability requires time. Meanwhile investors are likely to keep their preference with the precious metals. Growing imports in China and India, increased acquisition of precious metals by central banks, and pension funds will be a key factor determining the dynamics of the gold price in the medium and long term. Considering the economic forces in play and fears fueled by political instability, the growth of precious metals is far from over. Unlike the past, this time we may even witness a long term shift in the perceived role of gold as an asset in private and institutional portfolios. After all, gold has retained its purchasing power for centuries. Few currencies can compete with that.

There are a number of ways in which speculators can gain exposure to the gold price including funds, exchange traded vehicles, physical gold and gold coins, spread betting, CFDs, shares in mining companies as well as futures and options – with the main difference being whether the traders wishes to utilise gearing. Normally, buy and hold investors will buy into gold funds, exchange traded funds, mining shares or physical gold while traders may prefer to focus on futures, options, spread betting and contracts for difference, due to their shorter trading perspectives and their risk appetite to utilise leverage to amplify gains against price movements

Exchange Traded Funds

Cost effective investment instruments, such as ETFs issuing securities backed by physical stock, make ownership of gold and silver easier. ETFs are traded like normal stocks during trading sessions, allowing flexibility and making exposure to precious metals possible for a large group of investors. Examples include ETFS Physical Gold (PHAU) and iShares Physical Gold (SGLN).

Gold Coins

Gold in your hand is the ultimate hard money asset. But even the commonest “bullion coins” (such as the Krugerrand, Maple Leaf and Philharmonic) start at 5% mark-ups, with most dealers charging similar fees again when you sell. Because they’re deemed to be coin of the realm, British Sovereigns don’t attract Capital Gains Tax (CGT), but dealers often take back most of that saving in higher mark-ups.

So first you have to overcome the spread on the coins and here it is important to work out the buying premium over the spot price and the selling discount to gain an understanding of just how far off you are at the moment you are buying. Secondly, there is loss on taking physical delivery of the gold as the coinage is no longer secure or guaranteed. This loss cannot be recovered. In the days of the Gold Standard, people would take Sovereigns out of banks, shave bits off the coins and then proceed to return them for the same amount retaining the gold they had shaved.

Quite apart from gold coins one can also look at buying gold in bullion or bar form to reduce wastage and save further on processing fees.

Mining Stocks & Funds

It’s a popular myth that if gold is rising, then those miners digging it out of the ground should be soaring in price. Since the financial crisis began in mid-2007, gold has beaten both the major US mining-stock indexes (the Philadelphia Gold & Silver XAU, and Amex Gold Bugs HUI), plus the top managed funds, including the UK’s No.1, Blackrock Gold & General, and with lower volatility to boot. In fact, gold is much less volatile than most people think. It’s true that a handful of individual stocks have performed well (Randgold’s Nasdaq listing has quintupled in price since ‘05) and risk-loving investors will always find explorers and junior mining stocks alluring. The truth is that gold-based exchange-traded funds have reduced the demand for investing directly into gold stocks. But mining shares also carry management, credit, political and inputcost risks which gold itself doesn’t suffer. Add to that the fact that in 2010, most gold mining stocks were rising in value irrespective of the quality of their portfolio and this all came to a sudden end when many of these companies underperformed and underdelivered. Increasing costs and falling profit margins have also hit the mining sector while geopolitical risks are aggravating the problem. Just to mention a couple of names, gold and commodities-heavy funds include the likes of S&W Global Gold & Resources and Investec Global Gold while MFM Junior Gold specializes in small producers.

On the supply side, China is also the world’s largest miner today, overtaking Australia and the USA in 2007 and now producing 50% more than ex-No.1, South Africa. Global mine output rose 7% in 2009, but costs and risks are both rising fast, particularly when you consider that mines in South Africa can go as much as 5 kilometres under the ground. The costs and risks are also rising thanks to socialist governments and green lobby groups either taxing or blocking new sites. Europe’s central banks meantime stopped their gold sales as the global financial crisis hit, but take note – the other great “legacy” stockpile, unwanted gold jewellery, has opened up like never before. Other producing nations include Peru and Russia. The level of productions tends to increase a little every year but gold production tends to be prone to disruptments (particularly in the short-term) by things like accidents, strikes or even problems with electricity cables.

Why do they say that mining companies are a leveraged way to play the gold price?

I presume they mean that if the cost per oz is, say, $1,000, and the price of gold is $1,500, then profit would amount to $500, but if the price of gold were to increase to $2,000 while the cost per oz stays the same then profit would amount to $1,000. Gold has risen by a third, but company profit has doubled. Hence leverage. Companies with high costs have more to gain if the price of gold increases, but more to lose if the price of gold falls.

“Financial spread betting is a derivative and as such you do not own the underlying asset but you can still profit from market movements in the price of gold via a spread bet”

Spread Betting

These days the price of gold seems quite expensive. So how do you get your position in the market without having to put up a considerable amount of capital. Spread betting, being a margin traded product, offers a simpler way to leverage your money, plus it enables you to access the gold price in dollars – a big advantage if that’s where you think the real moves will come. Take care, however. Because many europe-based hedge funds got hurt during the financial crisis (and again in 2010) when the second-leg of their long gold, short dollar positions blew up and the euro sank against gold. despite going long, they failed to get the basic currency-hedge gains they would have made for their clients by not being so clever. And gold, as we saw, is awfully simple – major attraction as the bubble in complex financial products continues to burst.

As financial spread betting is essentially a derivative you do not own the physical gold when you take a position and this also permits you to profit from market declines as well as rises in the price of gold.

Qualities that traders like about gold is that it can be traded almost on a 24-hour basis and the fact that it can move sufficiently to create good short-term trading opportunities. Spread betting providers typically quote the market at 0.1 basis points per USA dollar, which effectively means that for every dollar movement a trader would gain or lose 10 times the stake. Thus if you were to buy £15 worth of points and gold moves up $3, you would make £450 (15 x 3 x 10).

Trading with a spread betting provider you can take a position on whether you believe the price of gold will rise or fall. If you are correct in your prediciton and the price of gold moves in the direction of your trade, you will make a gain of your stake multiplied by the number of points that the market has moved. Should your prediction turn out to be wrong, you will suffer a loss of your stake multiplied by each point that the market has moved against your position.

The London Metal Exchange

This is a peculiar market in that various metals are traded in short burst at fixed times during the day. These times are called ‘Rings’. A ‘ring’ is a five minute period which a particular metal is traded.

Here is the partial timetable to give you the flavour.

Morning Rings at the London Metal Exchange -:

| Secondary Aluminium | 11.45 – 11.50 |

| Tin | 11.50 – 11.55 |

| Aluminium | 11.55 – 12.00 |

| Copper | 12.00 – 12.05 |

| Lead | 12.05 – 12.10 |

| Zinc | 12.10 – 12.15 |

| Nickel | 12.15 – 12.20 |

| Break | 12.20 – 12.30 |

There is a peculiarity when trading metals. The main quoted price for metals on the London Metal Exchange is for a 3-month period. This is not (as in the case of an index) a particular date (like end of March) but literally three months from the date of the quote. Thus, if it is January 1st and you get a 3-month quote for aluminium, that means the quote is for (roughly) March 31st. If you call on January 14th for another 3-month quote, then this is the quote for 14th April, approx.

Most people start trading metals by taking a 3-month position, say buying 3-month copper. Let’s say you do this on January 1st, and so your price is for copper on about March 31st. You call for a 3-month price on Feb 1st and find that the market has moved in your favour, however, you cannot place a ‘sell’ order for 3-month copper! You must sell the exact date you bought, e.g. end of March. This price (for 2-month copper, if you like) may or may not reflect the price of 3-month copper. You could make more money than you thought, or lose more than you thought.

Metals and commodities outside the London Metal Exchange tend to have fixed trading periods as for the indices. These vary from commodity to commodity. When you join a spread betting company check the handbook with all of these details in.

Gold vs Silver

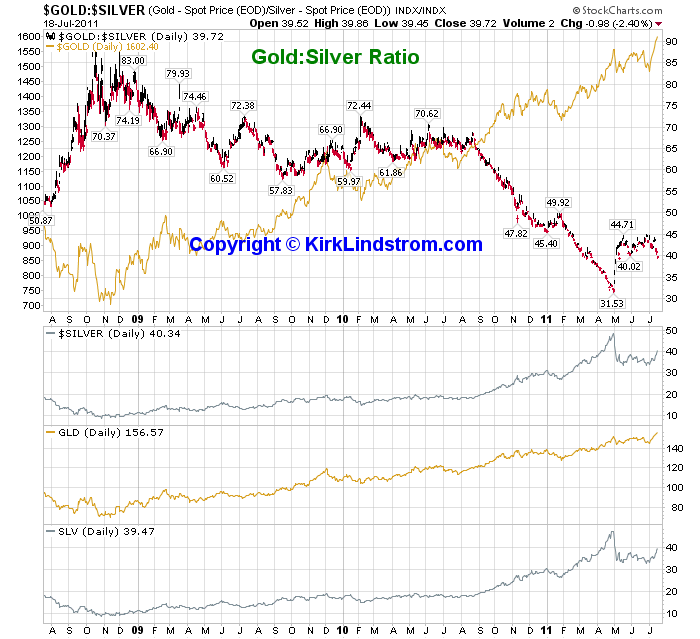

The spot price of silver has historically been linked to follow gold, so the theory is that as the gold price rises, the price of silver will follow. However, while gold as an asset is mainly seen as a safe haven of wealth in times of economic crisis, silver is mainly used in industrial applications so its price is tied to the global recovery. Note also that the price of silver is more volatile than the price of gold and while reached a high of $48.58 per ounce in April 2011, it quickly retraced back to $32 an ounce in just a few weeks.

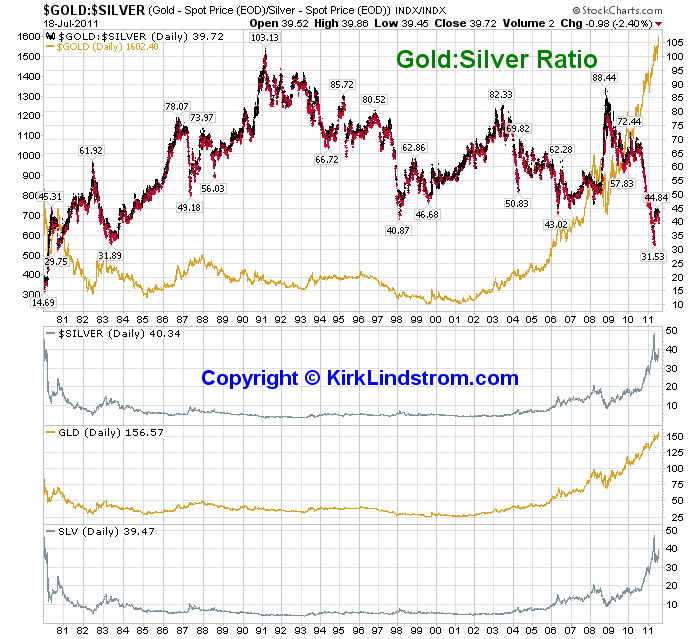

You can also take a punt on a commodities index and thus avoid the foreign exchange risk while focusing only on the movements between two commodities such as gold and silver. For instance, the gold-to-silver price ratio, which in practice is defined as the price of an ounce of gold divided by the price of an ounce of silver, was trading at $39.72 at the time of writing (July 2011). This means an ounce of gold is now less than 40 times more expensive than an ounce of silver. Back in 1991, gold was over 100 times more expensive than silver and this means that silver is now sharply overvalued against gold, and one would do well to keep in mind the narrowing gap between the buying of gold and the shorting of silver. By checking this movement you will be able to sort out when gold is starting to outperform the silver market and thereby begin to close the gap.

3-Yr Chart of Gold Silver Ratio

Chart of Gold Silver Ratio 1981 to Now

Gold Spread Betting Example

With gold, most spread betting allow gearing of up to 20 times the initial stake. The flipside of leverage is of course that potential losses can also be magnified accordingly.

A practical way to get exposure to gold is to take a medium-term position on the two-month COMEX futures contracts. Alternatively, if you wish to target shorter-term moves, you can use the daily rolling bets that mirror the spot price. Daily rolling bets can be rolled over from day to day for a small financing charge – otherwise they will expire somewhere around 10pm.

Gold Spread Betting Example 1

On September 16, IG Index was quoting a spread of $1402.3/$1403.3 for the gold price (per ounce of gold). If you had gone long (bought) the gold contract in the expectation that the gold price would continue to rally and had staked 100 a point (in this case, one point is equivalent to a 1 dollar movement in the price), you would have made a 20,100 profit if you had closed your position after two months. At that time IG Index was quoting $1604.3/$1605.3. So if you sold your position back at $1604.3 (originally bought at $1403.3) this would have netted you 201.0 x 100 = 20,100 profit. Keep in mind that whilst the gold price is quoted in USA dollars, spread bets can be denominated in pounds or euros or even USA dollars.

Do make sure to check the tick size as some spread betting providers like Capital Spreads and City Index will use a tenth of a dollar/troy ounce, while at IG Index this is ten times larger. The typical margin amounts to 1% or 2% of the effective exposure and the spread around 6 points. Let’s take an example from Capital Spreads. Suppose gold is trading at $1402 and you believe that it will hit $1420 within the next few days. You go long at 50p per point. At Capital Spreads this would mean that for every 10¢ that gold rises or falls, you’ll make or lose 50p. Your market exposure amounts to (10 X 0.50 x 1402) = £7010. However, you don’t need to deposit £7010 – a spread betting provider might permit you to open this trade with just £701 in your account. For the balance you would effectively be borrowing and you would then pay a small daily financing interest fee upon. If your hunch is correct and gold rises to $1,420, your profit would amount to $18 x 10 x 50p = £90. Had it fallen $18, you’d have made a similar loss.

Gold Spread Betting Example 2

Example: Buying Comex Gold futures

You think gold is about to rise in value. For gold, one point means one troy ounce and the deposit factor could be, say 10. You check the price for December Comex Gold (This is not an LME transaction and so we deal in fixed periods). You are quoted 1506/1508. This means that gold is expected to be about $1507 an ounce by December. You BUY December gold at $100/point = $100/ounce. The deposit is 10 x $100 = $1000.00, payable immediately. Gold soars in value and you decide to sell when the December gold price hits $1560

Opening position: 1508

Closing position: 1560

Difference: 52 x $100 = $5,200

Notice that the bet takes place in pounds, even though gold is quoted in dollars. This is different from contracts for differences or say, futures, where you’re trading in dollars. If you were trading using another currency other than your own it could lead to problems in that, say, 2% profit on the commodity and a 3% loss on the foreign currency, would leave you nursing an overall loss even though you were right on the market direction.

For active spread traders, metals spread betting can offer leveraged returns for very small initial capital outlays. However, the downside is that it can also create big losses if the market moves against your position. So how can you protect yourself? This is where guaranteed stops have a useful role as they serve to close trades at specific levels chosen by you if the market moves against your trade.

Suppose you had bought £5 per point of the Gold Rolling Spread at 1500, and set 1450 as your stop level, hence putting at risk £250 (1500-1450 x £2). You could make sue or a guaranteed stop to make sure that should the market breach the 1450 level, the trading platform would automatically close out your trade to protect you from any additional losses.

So where’s the gold price heading? The gold metal’s price spiked to $1,989 per troy ounce in 2011 due to global economic concerns, however the price has now subsided back to around the $1,600 level. Low interest rates are forcing investors to seek other means of capital appreciation and protection against inflation. Meanwhile continual central bank gold buying from countries around the world coupled with limited supply and increased demand are all likely to support the price of gold particularly if further quantitative easing continues taking place. Of course others are of the opinion that there is as much likelihood for the market being at $1000 as there is of it rising to $2000.

Is the gold price crashing or is this a correctional phase of a bull run?

Personal Opinion from a Gold Investor: Well, it depends who you ask – different participants in the market have different opinions which is why the market exists. As the price of gold drops, metal demand is likely to pick up, as if it is going into a parabolic phase on a downside price trend…

The bears have control of the price, the bulls increasingly have control of the metal, but the bulls and especially the new bulls will have the bulk of the free gold in lock down by the time the bears give up, leaving just annual production and scrap to cover the demands of the repayment of the highly hypothecated market and shorts…

Interest rates are the black swan event for the banks as there are quadrillions of interest derivatives betting on interest rates staying low…Gold price has to be contained as has interest rates whilst the Fed prints to oblivion, any sign of inflation escaping control, requiring interest rise, or deflation shrinking government tax & revenue & the balloon goes up… Unlike the usual saying when the Gold runs out “The old lady sings” the old lady of Threedneedle ST (BOE that is) & a whole load of city slickers need a new job…

The BOE seems to have leased/sold 1200 tons of gold this as part of the price suppression scheme, now the UK only has 350ish tons that we own, before this event, so whose Gold was sold, at the bottom of the market,(close to production costs) can it ever be replaced… As regards to timing look at the Cyprus Banking event, it would have been better to plan & action before rather than after….

“Gold’s phenomenal rise in 2010 when prices rallied up by almost a third were mostly driven by market participants buying the precious metal as protection from the Eurozone market turmoil. However, the dollar has since largely taken over the ‘safe haven’ status which is strange in itself given the extent of money being printed.”

Dos and Don’ts of Gold and Oil

- Do use gold as a hedge against inflation, currency jitters and stock market turbulence.

- Do consider a spread bet short-term speculation on gold and oil as these allow you to take advantage of both rising and falling markets.

- Do make sure to take appropriate risk reduction measures like money management (stake sizing) and stops when trading gold or oil.

- Don’t expect a smooth ride. The prices of gold and oil are inherently very volatile and can move quickly up or down.

- Don’t overlook the influence of oil on other companies in your portfolio whose industries are dependent on oil. For instance, as well as the obvious candidates such as BP and Shell, the oil price will also impact the performance of other enterprises such as airlines, haulage firms and transport companies.

Note: Gold is also a good market to test your trading strategies. I remember that when I started day trading some years back I tried paper trading for a while thinking that it would teach me discipline. With hindsight it was nothing more than a waste of time. If you’ve got a strategy you want to test simply trade it on IG Index’s spread betting daily spot gold at £1pp. The risk is so small that even if a trade goes badly against you the loss will probably only amount to £5-15. Gold is not worth trading less than 5 min chart. Obviously your wins will be very small but that’s not important, its the process of trading and understanding your strategy and its money management that will make you profitable. £1pp gold is also the best way to build trading confidence – much better than forex or FTSE.